Do you feel physical pain when you spend your money? Do you experience negative emotions when you buy something? You are not alone. Behavioural scientists have proven that pain centres in our brain activate in financial transactions, which explains why humans hurt in such occasions. It’s called the ‘pain of paying’, and it’s a pain so real that most of us would rather not lose £5 than find £10… loosely restating Kahneman’s and Tversky’s earlier findings about the pain of loss being twice as intense as the joy of gain.

Counter-intuitively, the solution for brands is not a lower price. We tested this and no matter how much we lowered price in our experiments, our results concluded that the price itself never brought a brand into consideration. Not if consumers didn’t consider buying the respective brand in the first place. So, if a lower price is not the answer, what is?

It all comes down to how a brand communicates, frames and contextualises its price. The data at my disposal steered my thinking towards three pots: value, price-framing ideas and clever advertising. And the data suggests if we do this well, we might just lessen consumers’ ‘pain of paying’. Have I captured your interest?

Let me unfold the evidence in this 3-step guide:

1. Keep calm and carry on the value talk.

My good colleague J. Walker Smith maintains that price has been the secret sauce of brand success since the pandemic. For the last three years, there’s been plenty of money in the economy -- tied to COVID-19 government relief programs and people’s excess saving during the same period -- but supply (mainly due to chain shortages) failed to increase accordingly. Demand trumped supply, therefore prices and inflation skyrocketed. Many brands benefitted from this, i.e. they continued to grow on price increases despite shrinking sales. But now, there’s a wind of change: savings are vanishing, inflation is subsiding, people’s disposable income has taken a hit. The average consumer is unlikely to entertain another price hike.

Still, consumers will continue to spend (often considerably more) on brands that offer them value. So, what if 2023 was a tough year financially? Premier Inn still had new and repeat customers booking in droves to ‘rest easy’ in 90,000 newly installed Silentnight beds across the network. So, what if 2008 ushered in a financial crisis that turned into a great recession? Apple’s then newly launched iPhones still had people with tingling hands queuing outside stores to get hold of the unprecedented phone value on offer.

The lesson here is not to be Apple -- we can’t all be -- rather the lesson is to aspire to this gold standard, and to deliver on our promises in good times and bad (like Premier Inn did). To signal to our customers that we have no intention of removing value from our value proposition. When framing your price, these truths need to come out.

So, keep calm and carry on the value talk (and walk).

2. Use tips from behavioural economics.

Survey design supremo, Jon Puleston, has tested and concluded on the best ways to visualise choice knowing well that marketers can optimise their brand’s price with a little bit of psychology. The type of psychology that helps category buyers perceive the price to be lower than it is and motivates them to buy. Here are four experiments that stand out for me:

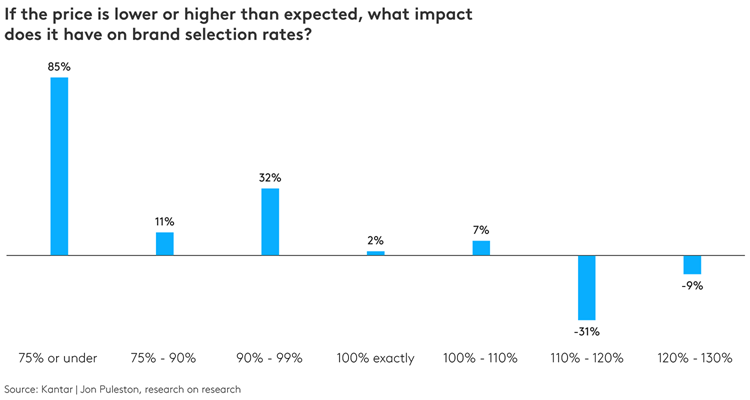

• Your profitability sweet spot can be found just above the expected price. The fact that consumers are twice as likely to buy your brand if its price is 75% or under what’s expected is merely an interesting fact that will damage your profits.

It’s slightly outside the price range I anticipated, yet I am 7% more likely to buy it.

• 99p might just be a worn-out price point. In luxury categories (like cosmetics No7) .95 is seen as reasonably priced, but .99 backfires as a sign of cheapness. Similarly with mobile phones, a price drop from ₹60k to ₹59,999 generated marginally more interest among our respondents, but when it dropped to ₹58,700, their willingness to buy shot up by 50%.

• Crossing the 100 (e.g. £5.00) and 50 (e.g. £5.50) price points can have a significant impact on choice. We tested a beer brand increase of 20%. Our respondents felt more disheartened with the price change from £4.90 to £5.10 (N.B. it crossed 100) but came more easily to terms with the price surge from £4.60 to £4.80. Similarly, respondents’ disappointment was greater when our toothpaste increased its price by merely 6p (from £2.49 to £2.55, N.B. it crossed the 50 price point) than when the same toothpaste increased its price even more but stayed away from the £2.50 mark.

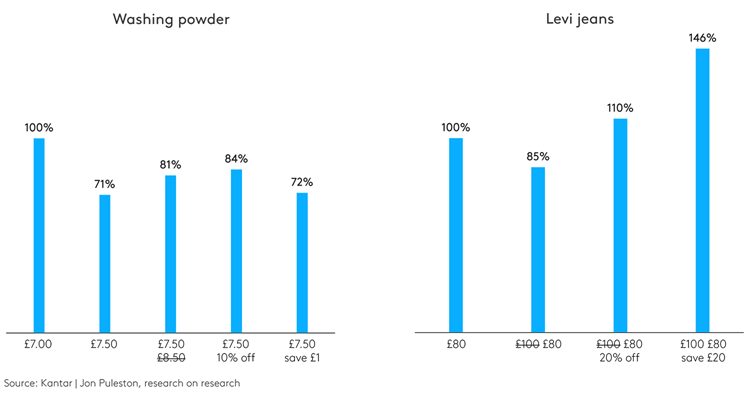

• When it comes to promotions, McKinlay Thomas’ simple rule of $10 vs. 10% off still applies. We tested it with washing powder and jeans and validated the two different framing discount methods. The results show that for cheaper products, it’s better to communicate the discount as x% off, whereas for pricier ones, price framing should include the amount off.

Economical? Show the x% off. Pricier? Highlight the amount off.

The above price framing tips (and many more Jon has from his experiments) increase a brand’s chances of being chosen in the last five yards. Pricing research to define consumers’ willingness to pay and the price itself precedes this step.

3. Unleash the power of online advertising.

Can advertising insulate volume sales from changes in price? Yes, but you first need to highlight your difference to consumers.

In the first article of our pricing trilogy, we proved that:

• For some brands, demand drops less (vs competitors) when price changes. These lucky brands have Pricing Power.

• Salience (aka mental availability) doesn’t move the needle of a brand’s Pricing Power.

• Meaningful Difference accounts for 94% of a brand’s Pricing Power.

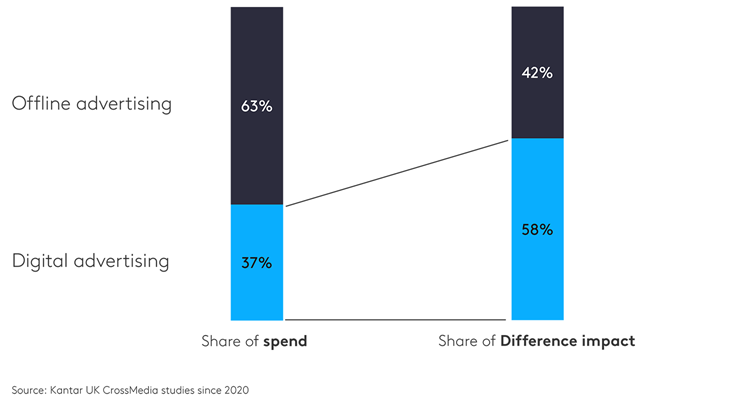

More recent results from our media effectiveness research reveal that although the average media budget’s online advertising spend is lower than offline, it over-indexes in affecting Difference. In other words, digital advertising is the driving force behind Brand Difference. Looking more closely, YouTube, Facebook and TikTok ranked top of the powerful assets for unlocking Brand Difference and a brand’s Pricing Power.

Digital advertising is the driving force behind Brand Difference

Are you still wary about budgeting against online advertising? Is digital advertising still one-dimensionally celebrated as cost-effective performance marketing in your business? If yes, this is the chart to use in the boardroom, along with the tagline ‘digital advertising unlocks Pricing Power’.

Commercial innovation can lessen consumer’s pain of paying.

If you want to increase your chances of getting lucky on a night out, take a similar looking but slightly less attractive friend with you, Dan Ariely advises in his book ‘Predictably Irrational’. Perhaps surprisingly, this is pricing, not dating advice.

Pricing is a comparative game, a game that more than half a million brands play every day to put their price in context. Some businesses out there have a special team dealing with this sort of thing. Their office door sign reads ‘Commercial Innovation’, and they come up with lures like ‘buy one get one free’, ‘3 for 2’ bundling, rundling, monthly instalments (…), relativity props like ‘the decoy effect’ (i.e. a third, similar but less attractive option – à la Ariely’s night out situation), comparative messaging like ‘as much as a cup of coffee’. They use behavioural economics and psychological pricing techniques to help consumers figure out what they want. In as little as one-third of a second, they (consumers) can suddenly alter their decision, simply because they think they are now getting a better deal. A change in their frame of mind that alleviates negative emotions and reduces consumers’ ‘pain of paying’.

In most businesses there is no specialised ‘commercial innovation’ team, rather it’s the marketer’s task to communicate their brand’s price. It’s an important task and shouldn’t be taken lightly. Marketers who can sell their product in different ways (without essentially changing the product itself) will make their brand more attractive to more consumers, and as a result, will make more profit for their business. But, remember: this is not a single player game. All our pricing efforts – whether it’s the additional value we bring to consumers, our price framing ideas or the ways we curate our digital advertising – need to be favourably compared against our competitors’. Whoever gets consumers to believe they are getting the better deal, wins.

Discover how to keep a permanent tab on pricing power with Kantar BrandTek equity and tracking solutions. Get in touch to find out more.