This ranking has been developed in partnership with The Banker. Read the coverage here

Like many other sectors, the banking landscape is evolving at a rapid pace. Digital disruption, shifting customer expectations and new entrants are reshaping how financial services are delivered and experienced. In this environment, the ability to adapt and grow has become critical for banks aiming to secure their future.

These are banks with momentum. Momentum is more than just rapid growth or technological innovation; it’s about a brand’s capacity to continually evolve, stay relevant and build lasting value, regardless of its age or size. Whether it’s a century-old institution or a digital-first challenger, a bank with momentum is one that consistently finds new ways to meet customer needs, differentiate itself from competitors and remain top-of-mind in a crowded market. In today’s world, momentum is a real indicator of a bank’s readiness for what comes next, and this momentum is measurable and quantifiable.

The predictive power of data

Kantar BrandZ has spent 25 years collecting and analysing data for 22,000 brands in over 50 markets, to understand how brands are built and how they grow. In the past year alone, BrandZ has evaluated over 300 retail banking brands globally, offering a comprehensive view of not only the strongest banks today, but those best positioned for tomorrow.Strong brands are able to create value for businesses in the present, as well as setting them up for success in the future. There are three qualities that position brands for growth - being Meaningful, Different and Salient. For banks, being Meaningful means meeting functional needs like being easy to use and having a range of accounts and services, as well as connecting emotionally with customers. Difference is about standing out, often through innovation, which reduces the chance of customer switching or disruption from competitors. Salience is about being top-of-mind and familiar to people. This framework, independently certified by the Marketing Accountability Standards Board, is the only brand equity model independently validated for its predictive power.

Banks with momentum

BrandZ’s ‘Future Power’ metric identifies the banks worldwide with the greatest momentum - those most likely to grow value share in the next 12 months. This list is diverse, spanning 24 markets and including both established institutions and fintech disruptors. Notably, nearly two-thirds of these banks also appear in The Banker’s Top 1000 list, and 11 are fintechs, highlighting the breadth of innovation and customer-centricity driving the sector.

Why are strong customer perceptions so important?

Banks with momentum have a clear growth advantage. Looking at growth in Tier 1 capital, the core measure of a bank’s financial strength, BrandZ’s ‘Banks with Momentum’ saw growth of +10%, two-thirds higher than the average in The Banker’s Top 1000. This relationship between positive customer sentiment and financial strength emphasises the importance of brand building for long-term growth, resilience, and investor confidence.What sets these banks apart?

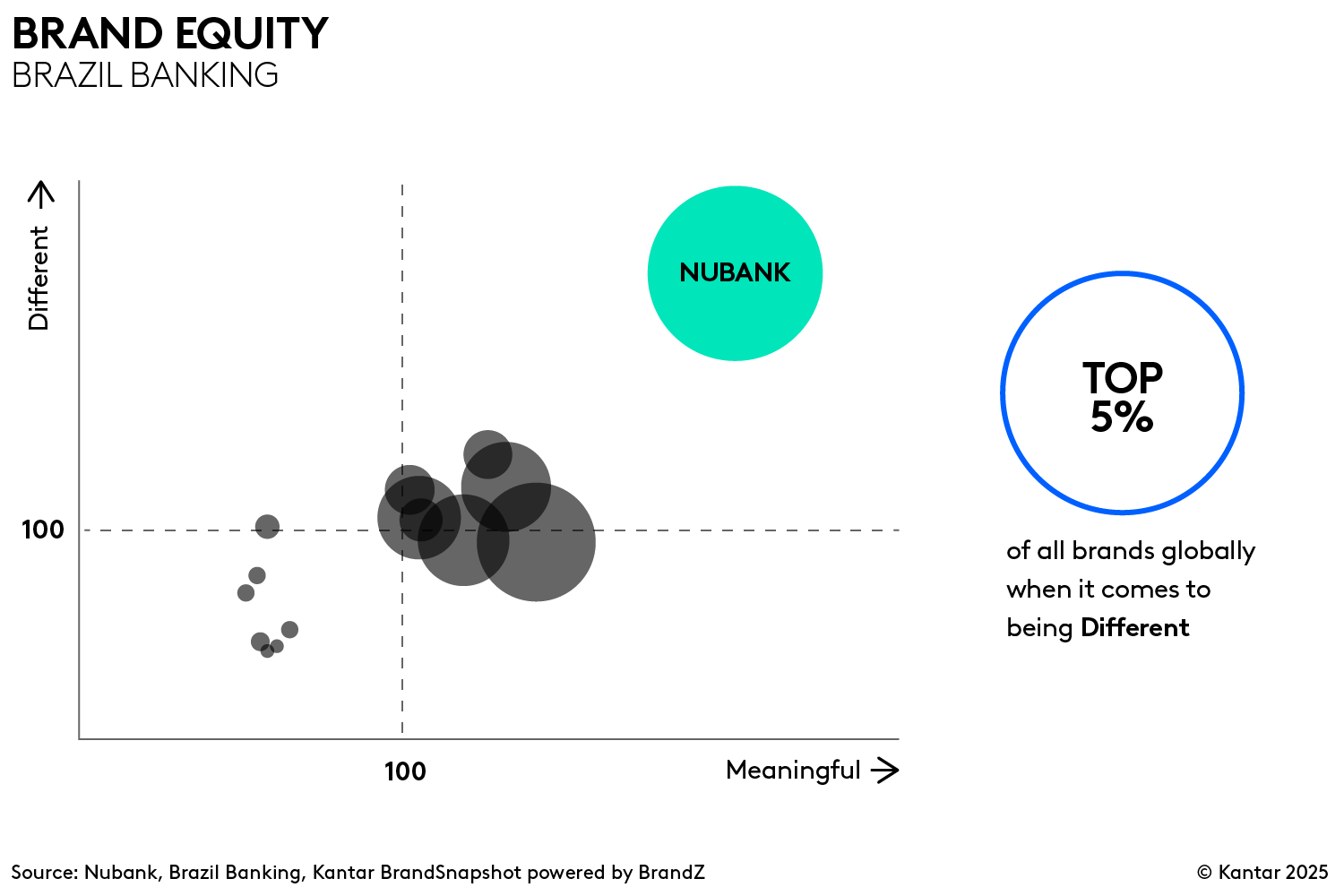

Nubank (Brazil): Latin America’s largest digital bank, Nubank, stands out for its commitment to financial inclusion, serving over 122 million customers with innovative products and a focus on the underbanked. Starting with a clear point of difference both in terms of product and positioning, Nubank has communicated its relevance to broad audiences in Brazil, establishing a strong foundation before turning its sights to expansion into Mexico and Colombia.

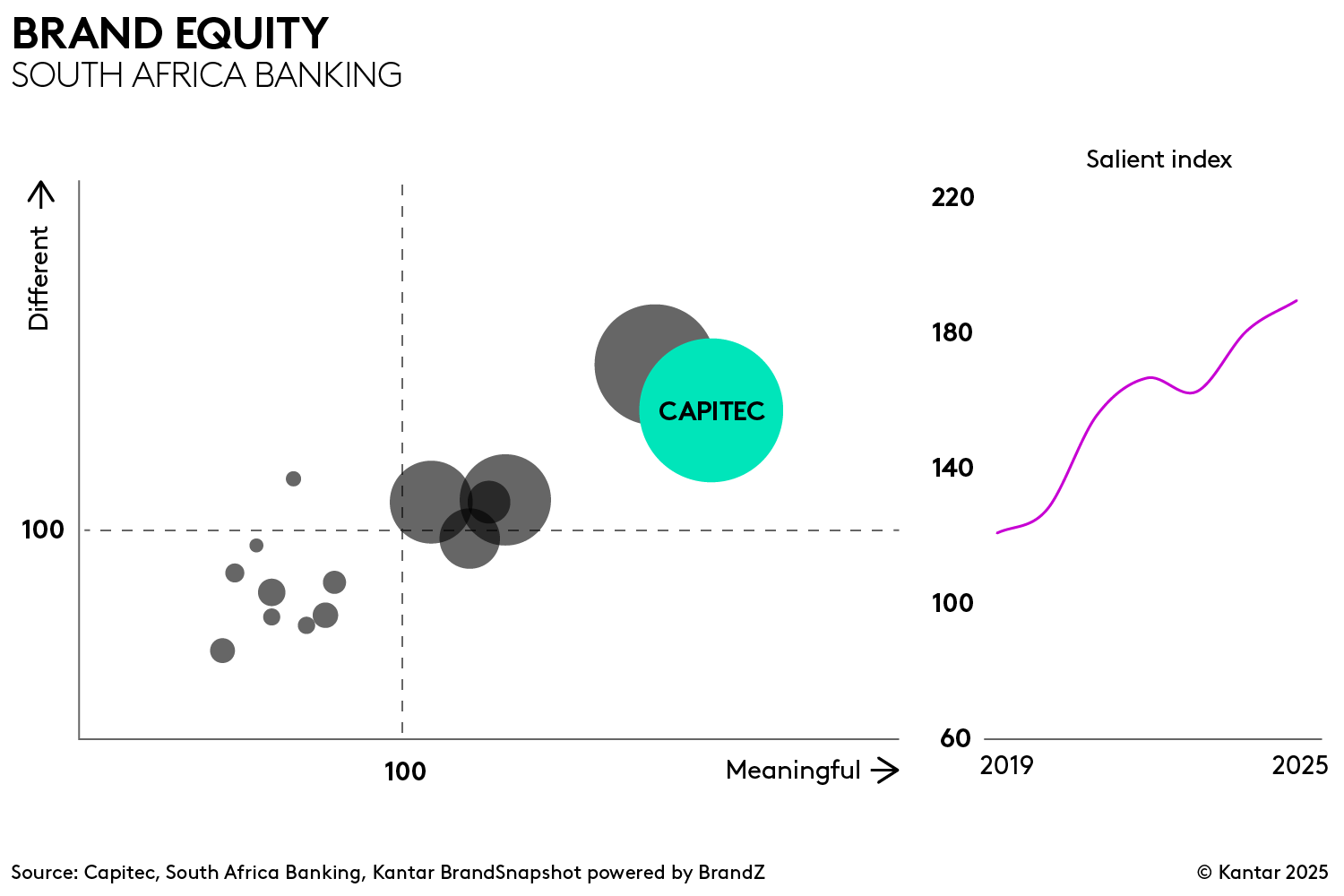

Capitec (South Africa): As the country’s largest retail bank, Capitec’s vast branch network and consistent advertising have made it highly salient, accessible and trusted. For the last decade it has been perceived to meet customer needs and offer the right services. Commitment to consistency across its advertising campaigns and relaying the stories of its customers, has given Capitec an authentic voice to amplify its offer.

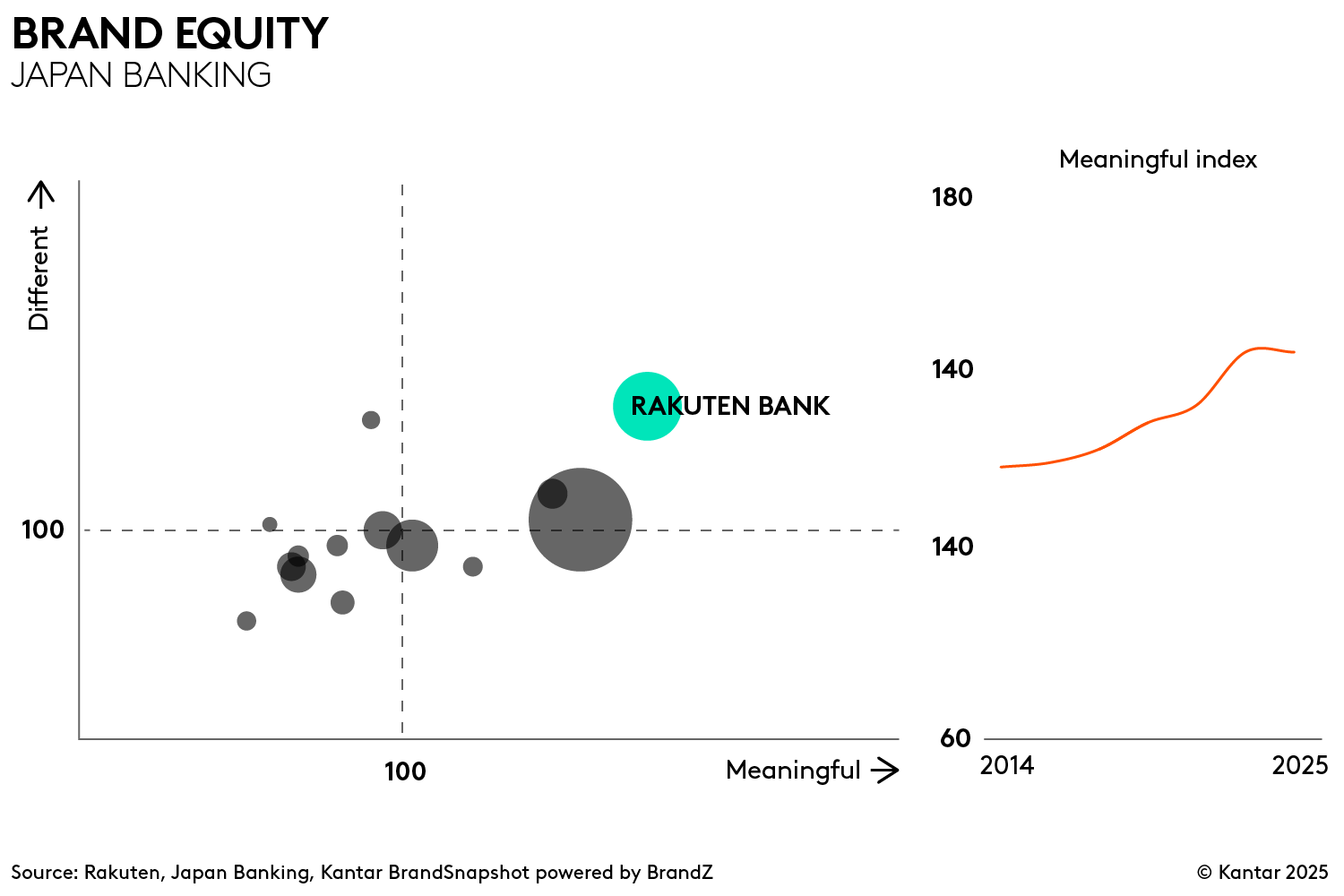

Rakuten Bank (Japan): Highly integrated into the Rakuten ecosystem, this digital-only bank is inherently different to others, but has also become more relevant to Japanese consumers, offering personalised experiences and seamless integration with daily life. Building these meaningful connections positions the bank well for future growth.

The banks that have been able to build positive customer perceptions, as well as deliver on these expectations with the experience they offer, have built trust as a result. Trust is a critical outcome of consistently strong customer experience. Banks with momentum are perceived to be more trusted than competitors, thanks to delivery of reliable service, expertise, and leadership.

The proof in the product

Brand building must go beyond advertising. Products and experiences are critical in creating the perception of what makes the brand meaningful and different. They are the tangible reality that people can see and use. This is particularly so in banking, where 58% of total brand perceptions are formed from the experiences. The app alone makes up 12% of the total. It’s functionality and appearance have a ‘little and often’ effect in reinforcing what the brand stands for. However, it is product and experience propositions that most clearly set the brands out as being different. Think Monzo’s bill splitting, Revolut’s metal card, Nationwide’s branch promise, Santander’s 1|2|3 account. These create perceptions that remain in the memory for a long time – Barclays has long since retired Pingit, but it helped build the foundation of Barclays’ perception as a highly innovative bank.The secret to building momentum

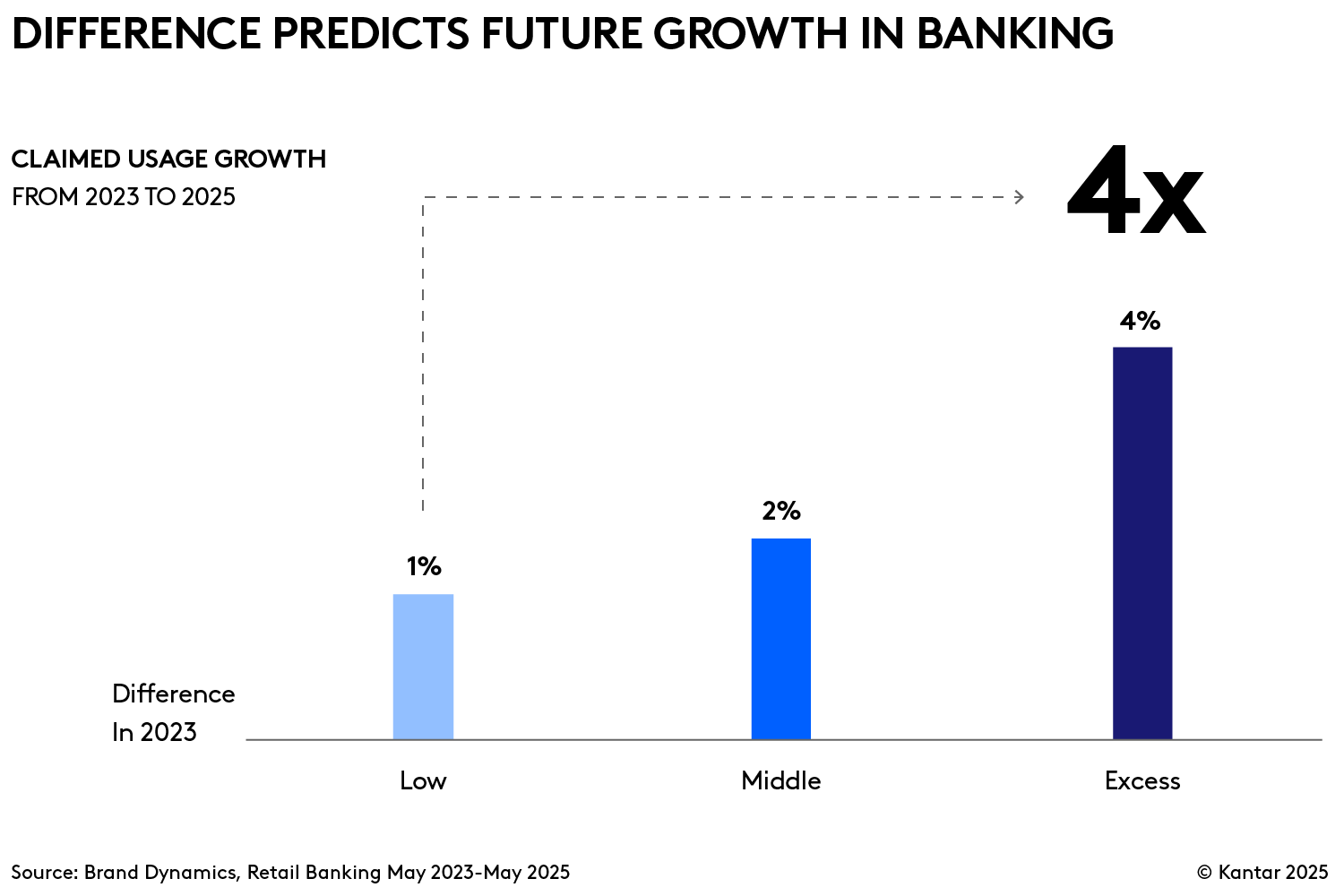

A clear sense of difference is vital for creating momentum for growth. Kantar BrandZ’s analysis of banks between 2023 and 2025 showed that banks that were perceived in the top third of difference in 2023, grew four times more than those in the bottom third by 2025, as shown in the chart below. Experiences must deliver on more than just satisfaction. The most important customer journeys and touchpoints must deliver on what the customer needs, but great experiences feel different to what customers get from other brands.

Momentum builds when you focus on both your brand and your customers. It’s about meeting people’s needs while bringing to life what makes your brand stand out. That means being clear about what makes your brand unique and making sure that comes through in everything you do.

Contact us to explore BrandZ’s Top 50 Banks with Momentum, developed in partnership with The Banker, and discover what sets these leading brands apart.

For a quick read on a brand’s performance compared to competitors in a specific category, Kantar’s free interactive tool, BrandSnapshot powered by BrandZ, provides intelligence on 14,000 brands. Find out more here.