how do you grow profitably when costs rise, and consumers scrutinise every penny?

The answer isn’t just to sell more. It’s to sell smarter. And that means harnessing a strategic asset most brands have overlooked for too long: Pricing Power.

Pricing: where strategy meets reality

“Pricing is the moment of truth,” says marketing professor Mark Bergen. “It’s where all your marketing strategy really meets that final decision point with your customers.”A 1% increase in price can boost operating profit by more than 10%, a finding backed by McKinsey and one that far outweighs the impact of equivalent changes in volume or cost.

Years later, both insights feel more urgent than ever. Rising costs and shrinking margins have turned pricing into the sharpest expression of marketing strategy, and the most powerful tool to protect profitability.

Volume rocks but it’s only half the story

Many marketers enter the industry with premium ambitions, thanks to Kotler’s classic pricing strategies. But once inside the business, they’re quickly pulled into marketing’s default bias: volume over value. Targets are set in units, success is measured in penetration, and discounting becomes the shortcut. Margin? That’s someone else’s problem.Pricing Power offers a different path. It’s not about charging more, it’s about being worth more. An opportunity to grow margins without sacrificing demand. And this isn’t theoretical. Our data shows that brands with high Pricing Power are bought at double the price of those with low Pricing Power. Also, that brands that improve their Pricing Power grow brand value twice as fast, even when penetration slips. So, what will it take to convince the industry that it’s the brand’s strength, not just its reach, that can quietly drive the biggest gains?

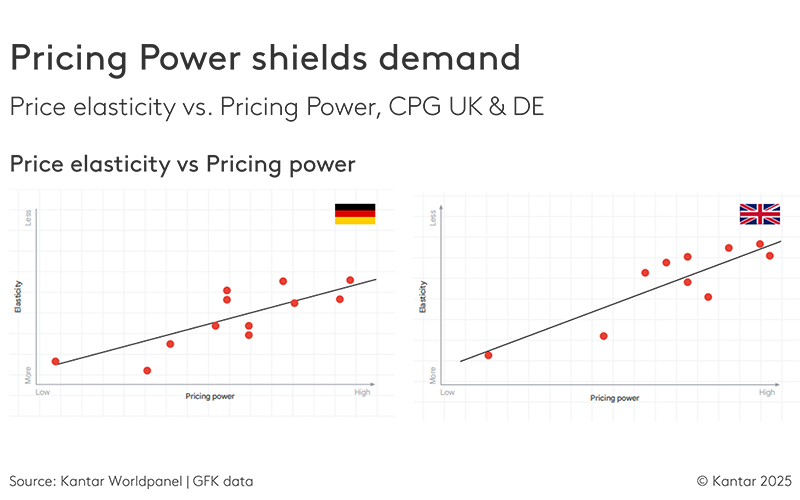

Pricing Power: a proxy for price elasticity

The link between a brand’s Pricing Power and its price elasticity is quantifiable. Brands with strong Pricing Power are better insulated from the commercial risks of price increases. These two scatter plots prove it: The horizontal axis captures Pricing Power: how much of a premium a brand can command based on consumer perception. The vertical axis reflects price elasticity: how sensitive customers are to price changes. The trend lines in both charts slope upward, confirming a consistent relationship: as Pricing Power increases, price elasticity decreases.

Pricing under pressure: when elasticity meets equity

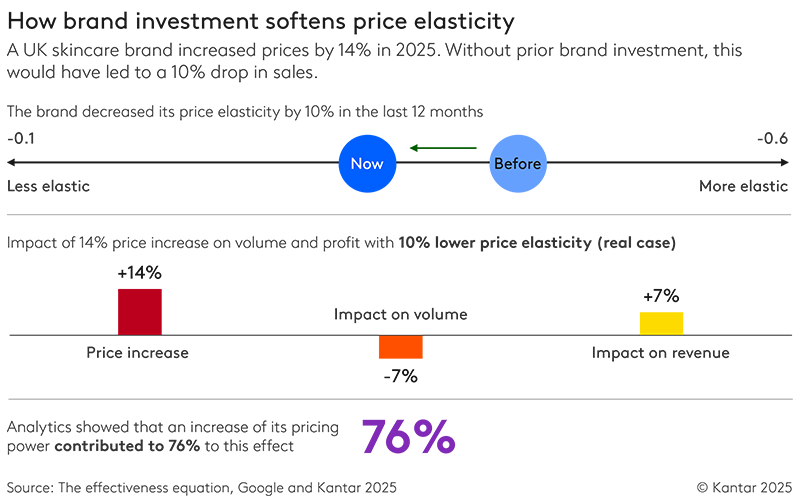

Let’s take a real-world example from our joint research with Google. A UK skincare brand raised its prices by 14%. Without strong brand investment, our model predicted a 10% drop in volume and a modest 2% revenue lift. But this brand had done the groundwork, investing in equity before the price change, and that changed everything.

The brand’s price elasticity improved from -0.7 to -0.6. Customers became less sensitive to price. Volume fell by only 7%, and revenue rose by 7%.

According to Google’s Michal Protasiuk:

“76% of that extra revenue came as a direct result of marketing investment.”

This is what commercial resilience looks like. Brands that avoid over-reliance on promotions and invest in long-term equity, build elasticity into their margins. And they give finance teams something they can work with: pricing flexibility backed by brand strength.

The margin multiplier: why low-margin brands should care most

If your brand runs on tight margins, this part is for you.

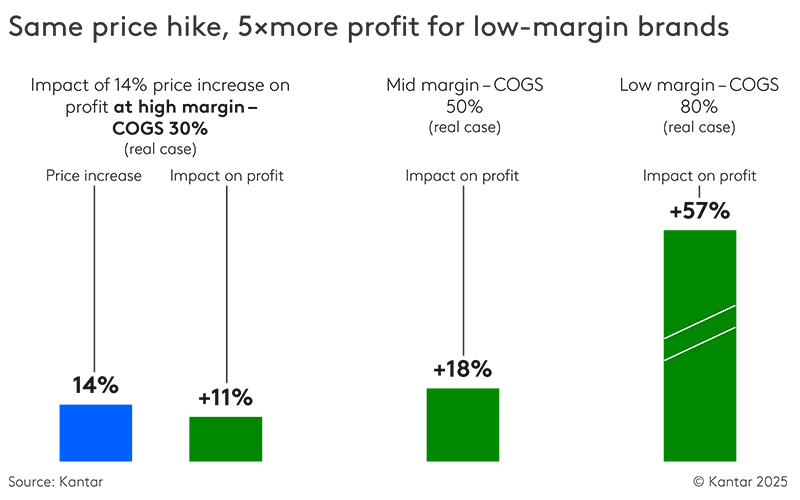

We modelled different margin scenarios to understand how price elasticity plays out across profit profiles. The result? Brands with lower margins stand to gain the most from improvements in Pricing Power.

For the same level of price increase, the profit impact for low-margin brands can be up to five times greater than for high-margin ones.

This flips the conventional wisdom. Pricing Power isn’t just for luxury brands; it’s a lifeline for everyday categories.

Meaningful Difference: the engine behind Pricing Power

If Pricing Power is the outcome, meaningful difference is what fuels it.

Kantar’s Meaningful Different and Salient framework shows that 94% of Pricing Power is explained by how meaningfully different a brand is perceived to be. Not salience. Not penetration. But perceived differentiation that meets real needs and earns the right to charge more.

So how do you build it?

1. Stand for something. Don’t just be known, be known for what you do best. That’s what earns a premium.

2. Price to value. If people believe your brand is worth more, they’ll pay more. That belief is built through consistency and connection.

3. Protect what you’ve built. Pricing Power is fragile. One misstep and the premium starts to slip.

4. Break the promotion habit. Promotions train people to wait. Brand building trains them to choose you.

5. Own the price conversation. Pricing isn’t just a finance lever; it’s a brand signal. If it doesn’t hold, neither does the equity.

Pricing Power in action

In 2020, Samsung outsold Apple in smartphone units. But Apple’s average selling price was $750, more than double Samsung’s $290. The result? Apple captured 61% of the entire smartphone industry’s profits. That’s Pricing Power in action. Not just more revenue, more profit.

More recently, McCain’s case took our industry by storm: their long-term investment in brand advertising reduced price sensitivity by 47% and increased base sales by 44%. An example that oozes commercial resilience. And they are not alone. Magnum’s “Stick to the Original” UK campaign didn’t just defend its price premium, it brought back shoppers who had drifted to cheaper copycats.

Another standout example comes from the IPA Gold-winning case study “They Went Short. We Went Long.” Direct Line Group assessed both short-term marketing drivers and long-term brand equity and found that brand contributed £46 million in profit. Why? Because even in the cutthroat world of price comparison sites, brand equity tipped the scales. That’s Pricing Power in action: not just holding your price but holding your ground.

The final word on Pricing Power

If you’re a brand leader, ask yourself:

- Can we raise prices without losing customers?

- Are we measuring our Pricing Power?

- Are we investing in the brand equity that drives it?

Three yeses don’t mean you should charge more. They mean you’ve earned the right to.

Because the strongest brands don’t push price. They justify it and decide when to flex it, whether to protect margin or convert it into volume. But either way, they’re in control.