Worldpanel's ComTech Smartphone Operating System (OS) study reveals signs of market stabilisation, whilst Apple continued to lead against Android-based competitors. Kantar’s Global OS study uncovers the following behaviours within the Global Smartphone market in Q1 2023:

- The global Smartphone market has shown signs of stabilisation in the first quarter of 2023, with the pace of decline slowing down compared to the previous year

- Apple iOS has continued its strong performance, with older models driving sales and a significant growth in some challenging markets

- Android OS sales have declined across Europe and the US, with Samsung and Google making gains, while challenger brands such as Oppo and Xiaomi have seen a sharp drop in share in some of their key markets

- Consumer recommendations and quality concerns are impacting Xiaomi and Oppo sales, with owners becoming increasingly dissatisfied with the battery life and camera quality of their devices

- Rising costs are causing consumers to become more cautious and lose their appetite for risk when it comes to choosing a Smartphone brand, disproportionately affecting smaller challenger brands

Global smartphone market shows signs of stabilisation as drop in sales slows

In the first quarter of 2023, there was a -9% decline in global Smartphone sales compared to the previous year. Despite the negative growth rate, the pace of decline is slowing down, mainly due to "base effects" that are helping to mitigate the current quarter's sales decline. However, this does not necessarily indicate a significant recovery; it merely reflects the low Smartphone sales of the previous year.

The Asian market shows the most significant stabilisation trend, with Mainland China experiencing a lower sales decline rate than the previous year, while Japan's sales remain mostly unchanged.

Australia, on the other hand, experienced a more significant decrease than the year before. Across Europe's five major markets (France, Germany, GB, Italy, and Spain), sales are still declining, but the severity of the drop is slowing down. Meanwhile, the United States sees an acceleration in sales decline, as consumers continue to postpone purchasing decisions.

Apple iOS strong performance continues with older models driving sales

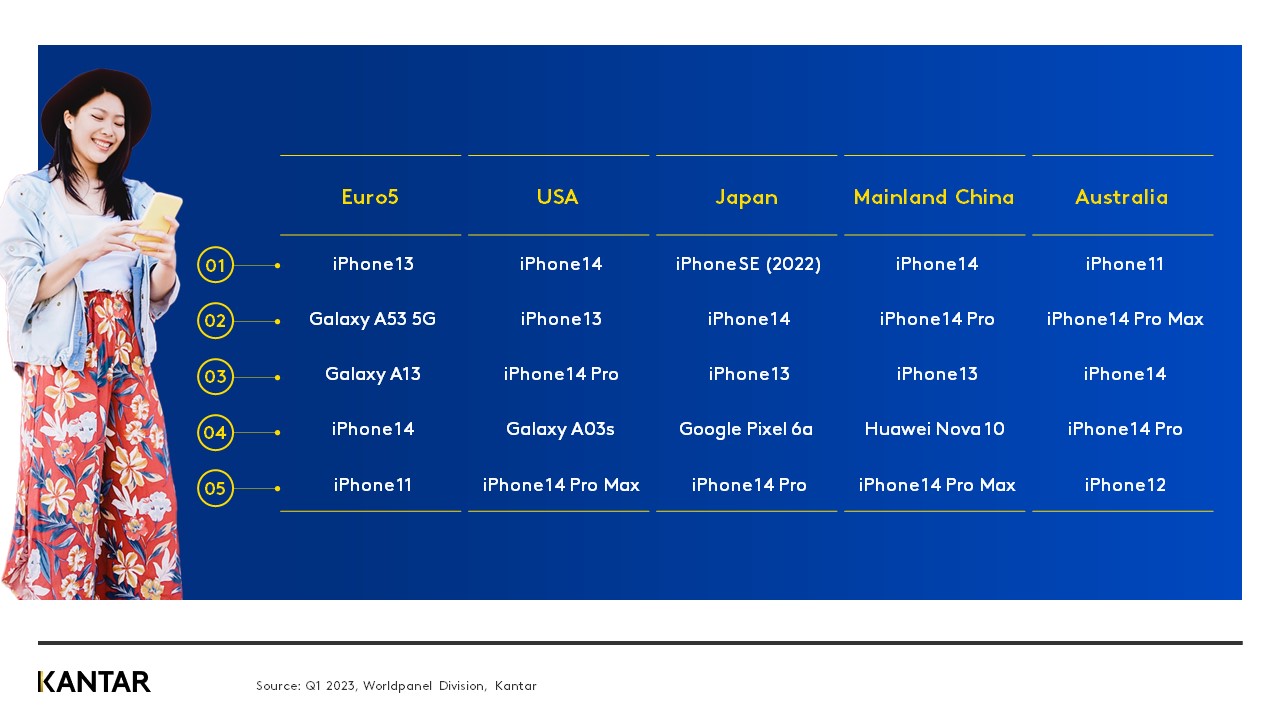

Apple iOS continues to build on its impressive recent performance, bucking the trend with strong global sales growth. While the demand for iPhones remains high, evidence suggests that consumers are increasingly opting for lower-cost models. In Europe, the iPhone 13 has emerged as the top-selling model, while in Australia, consumers are gravitating towards the three-year-old iPhone 11. In Japan, customers are shifting towards the recently launched iPhone SE (2022).

Across the European five, Apple's sales have increased by 2% year-on-year, driven by particularly robust performances in Spain (+6%) and France (+4%). This is a significant development for Apple, as these markets have traditionally been challenging for iOS, with Android enjoying a higher market share. In the United States, iOS has also recorded a strong growth of 1%, securing the highest share across all markets at 48%.

US consumers are continuing to demonstrate their loyalty to their domestic brand, and Apple is rewarding them for it. The company has recently introduced a Buy Now Pay Later offering to its Apple Pay service and launched a new high-yield savings account, both of which are exclusive to US consumers and provide a compelling incentive for non-iPhone users to switch to Apple. In Asia, iOS has experienced modest growth, with sales share increasing by 2% pts in both Australia and Japan. However, sales share was slightly down in Mainland China (-1%).

Android OS sales decline across Europe and US while Samsung and Google make gains

Android OS has experienced a challenging quarter. Indictive of its larger audience consumer base, many of whom are disproportionately affected by rising costs. Year on year Android OS sales share is down -1% across the European 5, driven by a sharp decline in Spain (-5%) and France (-4%). Of note, trouble appears to be brewing for challenger brands; Oppo and Xiaomi – with a sharp drop in share in some of their key markets – Spain, Italy, France, Japan and Mainland China, driven by declining consumer satisfaction and loyalty rates.

The US has also presented a difficult market, with Android sales share dropping by -1%pts. Motorola sales have decreased by -2%pts, while Samsung and Google have benefitted with +5%pts and +2%pts increase, respectively. The budget Samsung Galaxy A03s has emerged as the top-selling Android phone in the US.

In Asia, Android OS sales have declined by -3%pts in Japan and -1%pts in Australia. Samsung has had reason to celebrate in Australia, gaining +6%pts compared to last year. Google Pixel also experienced a strong performance in Japan, with the Pixel 6a becoming the 4th most popular handset. On the other hand, Android sales have increased by +4%pts in Mainland China, where domestic brands Oppo and Xiaomi experienced a challenging quarter, with a -4%pts drop in share. Vivo has emerged as the greatest beneficiary, gaining +3%pts to take the 2nd spot.

The declining trend in Android OS sales, especially in key markets, is a cause for concern for stakeholders. However, Samsung and Google's gains are a positive sign for the industry.

Consumer recommendations and quality concerns are impacting Xiaomi and Oppo sales

Across the European 5, consumer decision making is increasingly influenced by recommendations from friends, family, colleagues, and store staff. There is also a noticeable trend in consumers moving to brands with which they previously had a positive experience.

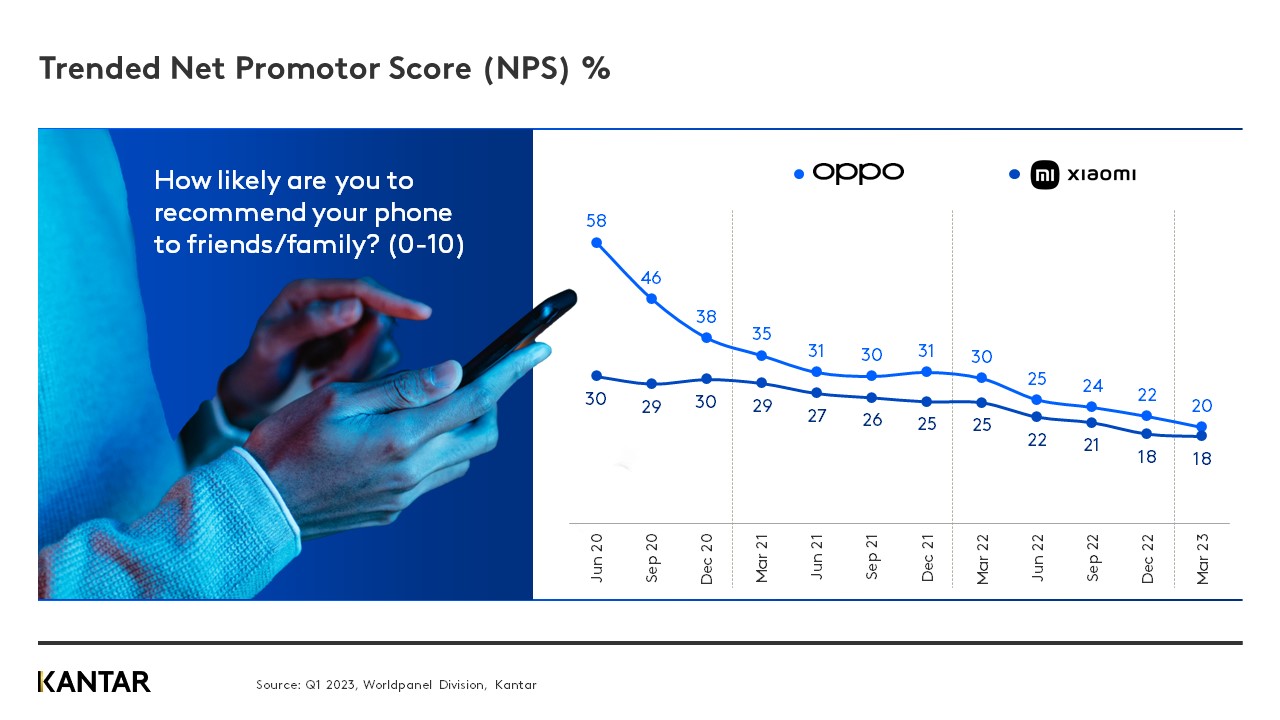

As rising costs continue, consumers are becoming more cautious and losing their appetite for risk when it comes to choosing a Smartphone brand. With smaller installed bases, challenger brands are disproportionately affected by this behaviour. Adding to this challenge, Xiaomi and Oppo owners are less likely to recommend their phone than the market average. This has been trending downward sharply over the past three years, with owners becoming increasingly dissatisfied with the battery life and camera quality of their devices.

Furthermore, there is a strong positive correlation between Net Promoter Score (NPS), which measures customer experience, and Smartphone sales. Xiaomi and Oppo, in particular, are impacted by this trend due to negative experiences reported by current owners. In response, both brands need to focus on product quality and address the concerns of their customers. Additionally, investing in marketing campaigns that emphasize positive aspects and encourage satisfied customers to recommend their products can help stabilise sales.