Worldpanel's ComTech data on the decision-making journey for technology devices reveals that the same brand ownership across multiple devices consolidates brand loyalty and drives revenue by increasing ‘premiumisation’ of its services. For example, Apple leads the way with 50% of owners owning multiple iOS devices, while Samsung has 21% owning more than one Samsung product.

Key findings from Worldpanel's ComTech Ecosystem data include:

- Building same brand ecosystems builds brand advocacy, generating additional revenue through service subscriptions and advertising.

- 52% of the population in the US and UK own a tablet, 28% own a Wearable, and 64% own a laptop.

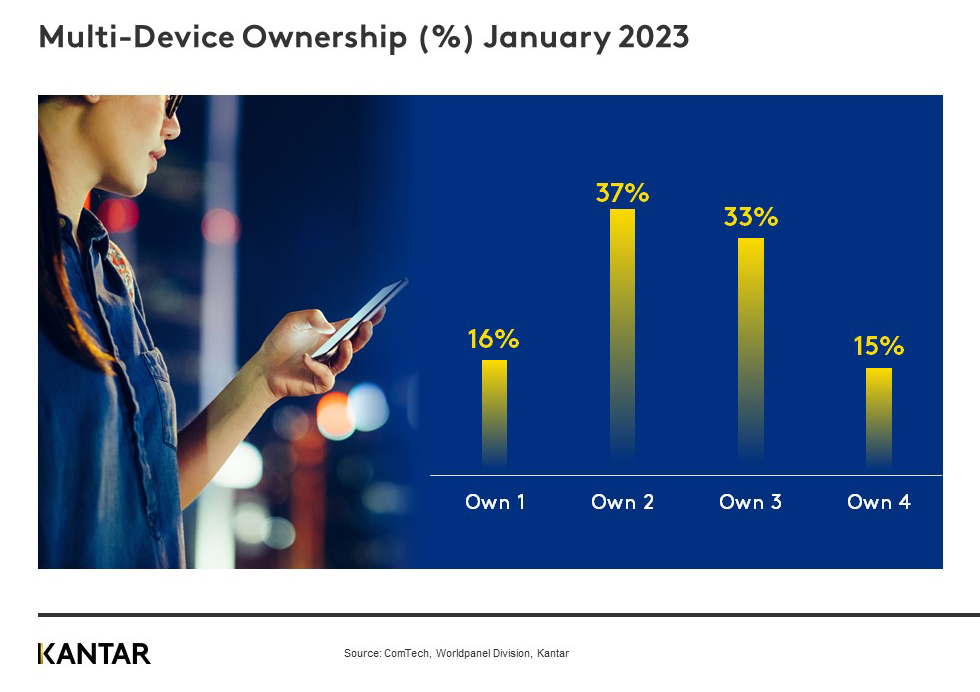

- In the past three years, the number of smartphone owners with four or more technology products has jumped 17%, reaching 15%.

- Apple’s increased multi-device loyalty versus Samsung is in part down to the seamless user experience that iOS provides users across multiple devices.

- Multiple device owners also tend to have a higher propensity to spend, buying premium smartphones and spending in other technologies.

By building same brand ecosystems, consumers become more entrenched, creating brand advocacy that drives manufacturer share and generates additional revenue through service subscriptions and advertising.

Furthermore, consumers who own multiple products from the same brand are more likely to remain loyal when they upgrade their smartphone, with 84% of Samsung owners who own at least one other Samsung device repurchasing Samsung, +5 percentage points greater than those who solely own a Samsung smartphone. Similarly, 97% of multiple device owners remain loyal to iPhone, +7 percentage points greater than those who solely own an iPhone. Apple’s increased multi-device loyalty versus Samsung is in part down to the seamless user experience that iOS provides users across multiple devices, an area Samsung can look to improve through further collaboration with Google Android.

Multiple device owners also tend to have a higher propensity to spend, buying premium smartphones and spending in other technologies. Kantar reports that 44% of consumers who own more than three technology devices spent more than $800 on their latest smartphone, versus 25% of consumers who only own a smartphone.

Same brand device ecosystems also lead to greater use of the brand’s services, presenting an additional revenue opportunity as hardware sales plateau. Apple’s services category generated $19.2 billion in revenue in Q4 2022 alone. Samsung smartphone owners who own at least one other Samsung device are more likely to stream Samsung TV+ (+116 over-index) on their devices. Greater engagement of a service not only drives impressions and revenue but also has a haloed benefit with consumers going on to recommend the manufacturers’ service to friends, family, and colleagues. Kantar’s Worldpanel Entertainment on Demand service reports that 20% of new video streaming subscribers spoke to friends or family before taking out a new service – an impactful, low-cost method of driving traction.

Manufacturers can build same brand ecosystems by strategically promoting and cross selling their products to both their existing and potential customer base. This can be done through targeted marketing campaigns and promotions that incentivise customers to purchase additional products from the same brand, such as bundling free products with the sale of another. Additionally, manufacturers should focus on creating a seamless user experience across all their devices and services, making it easy for customers to use and integrate multiple products from the same brand.