Lockdown changed our behaviour in multiple ways. At the start there was a rise in the indulgence of sweet baking, snacking and dessert occasions, but that quickly fell away. The longest lasting impact was seen in those behaviours that were previously satisfied by out-of-home (OOH) channels: cooked breakfast, takeaways, and socialising at home with barbecues or drinking alcohol.

For food and drink categories, the impact of lockdown was massive as OOH expenditure was slashed. By contrast, at-home consumption occasions rose by 13% globally when we compare March 2019 to March 2021, with figures hitting 21% for the United Kingdom, as we ate more of our meals at home, our new place of work, rest and play.

During lockdown, in-home lunch and snacking were the big beneficiaries. Looking at data covering March 2020 to March 2021 and comparing it with March 2019, it’s clear that globally we collectively took one extra lunch and one extra snacking occasion a week at home as a result of lockdowns.

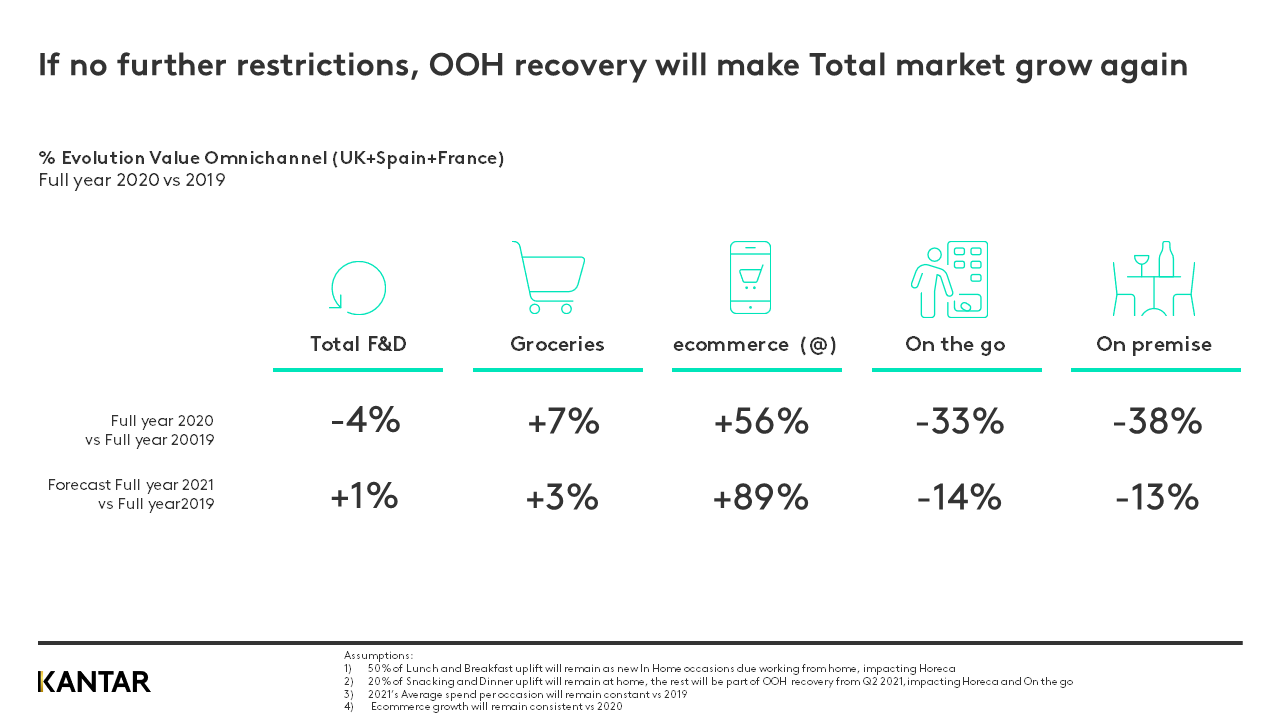

If restrictions are eased, our prediction is that the bulk of meal occasions that migrated to in-home, will return to OOH by the end of 2021 with only a small uplift from increased working at home. Overall, our forecast for the full year 2021 is that at-home food and drink consumption occasions will raise a 3% compared to 2019.

Although at-home occasions will not be growing as fast as during the pandemic, the growth of the food and drinking market will be led by the OOH recovery.

What will be more significant in these coming months are the three trends that COVID-19 has accelerated from the background in 2019 to business opportunity for brands and manufacturers in 2021 and beyond.

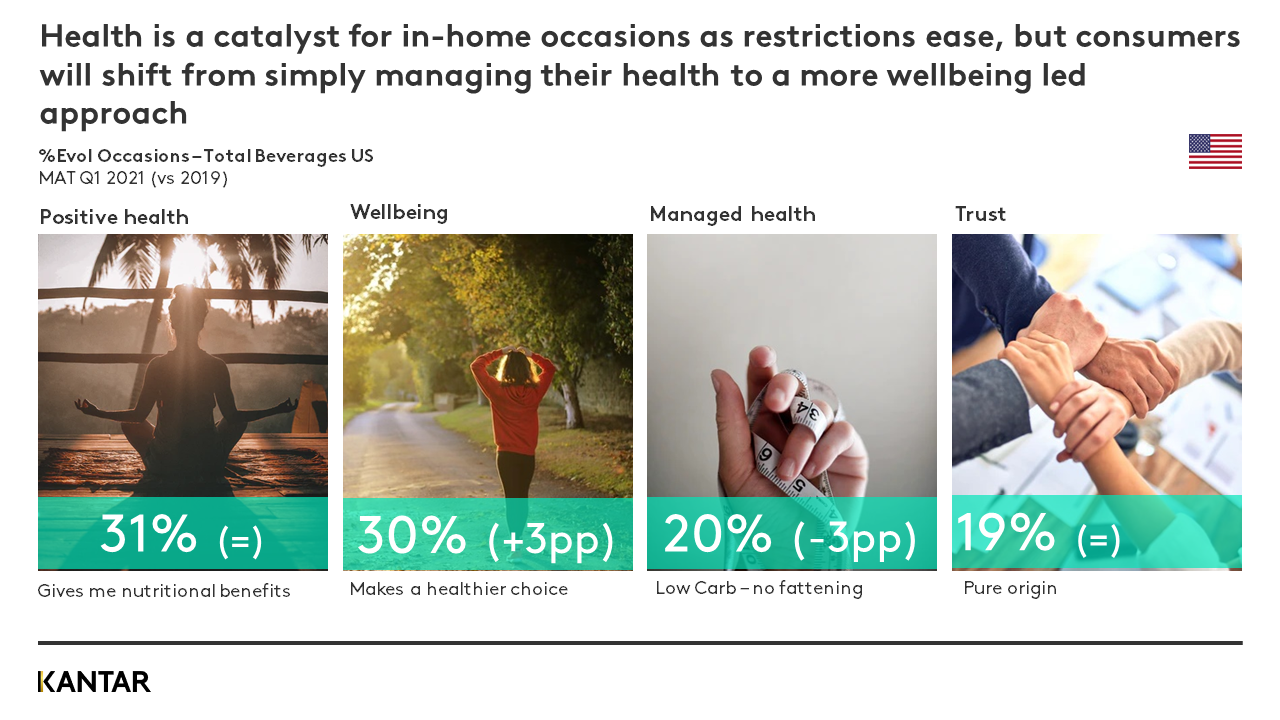

Focus on wellbeing and positive health

Enjoyment is the top consumption driver for snacking occasions – this is a trend that we first registered in 2016 and the pandemic has only accelerated it. The relevance of health in our snacking choices is always a priority when OOH consumption recovers, but the concept will transform post lockdown. In the United States, for example, beverage occasions have shifted to wellbeing needs such as healthier choice or feel good, rather than managed health needs such as low carb or low fat.

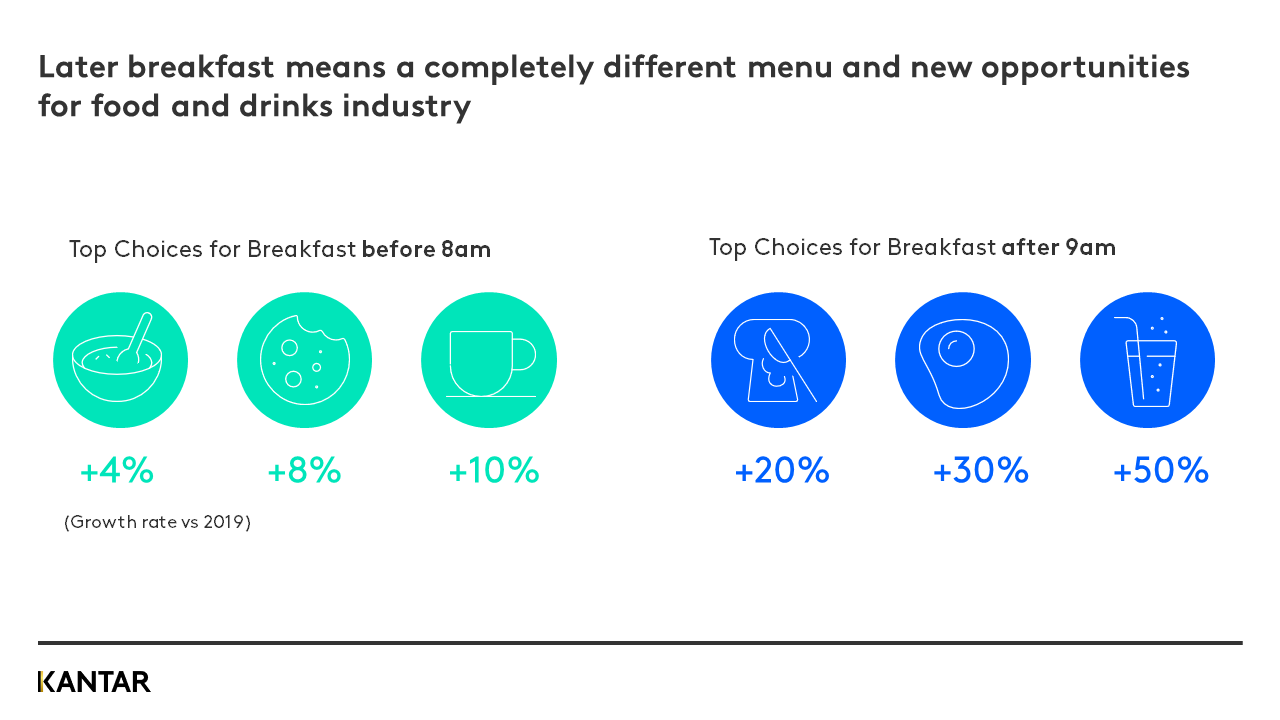

Breakfast transformed

The time we eat the first meal of the day has shifted, and changing what time we eat also changes what we choose to eat. More later breakfasts means more cooked food, less coffee and less cereal. Savoury breakfasts accounted for 24.6% of all breakfasts in Spain in Q1 2021, for example, up from 22.2% in Q1 2019, with avocado toasts as a popular breakfast option.

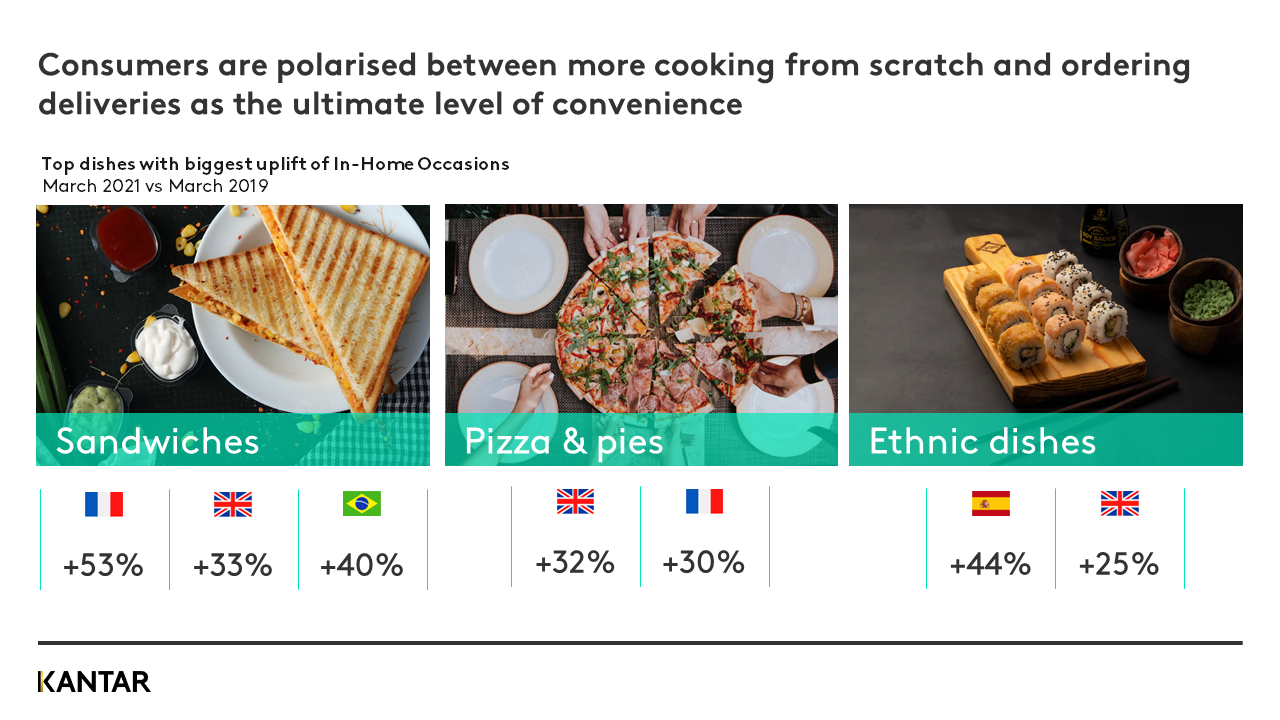

Cooking or not cooking but nothing in between

The in-home meal has polarised towards two extremes; cooking from scratch or convenience, often in the form of deliveries. Data from Mexico, for example, shows that deliveries are up 213% and cooking at home is up 6% but meals that are made from ready-to-eat products (-2%) or part prepared products (-20%) are down. Brands may need to reinvent the latter two options to resist the rise of delivery, which has become established as the ultimate in convenience and will continue to steal share.

Watch the webinar to find out more about the pandemic’s long-term impact on snacking and enjoyment, managed health and wellbeing, savoury breakfasts, and delivery as the latest level of convenience:

Nuria Moreno, Global Out-of-Home & Usage director, and Javier Sanchez, Global Out-of-Home & Usage manager, reveal how brands and retailers can leverage the opportunities now appearing as lockdown eases around the world.

You can also reach out to our experts and fill in the form below to get more insights.