In Spain over the last 18 months, we have seen a level of change in purchase and consumption patterns that would normally take place over a decade. The FMCG sector has proven to be extremely resilient, recovering better than the economy in general.

During the pandemic, the number of occasions for consuming food and drink products has stayed at a constant level. However, they have been happening in a different place and in a different way, with a major shift from out-of-home consumption to in-home consumption. This behaviour has also had an impact on other sectors, such as fashion and luxury cosmetics.

Since the restrictions have started being lifted, the effects have started to fade. The consumer is gradually resuming certain pre-pandemic habits. Our 2021 data shows that in-home consumption is growing by around 6% if we compare it to a non-pandemic year; and that out-of-home consumption, although still not at the same level as 2019, is at around the same penetration and spend per transaction as before the pandemic.

New times, old habits?

The majority (70.2%) of Spanish consumers have not seen their level of income affected by the pandemic, and 89.2% are optimistic about the future. This positive attitude is reflected in people socialising more, with the return of pre-COVID-19 beauty routines and greater out-of-home consumption.

In relation to new consumption moments, COVID-19 led to extra in-home occasions, some of which have become less frequent as society has reopened. Others will remain as a result of changes such as remote working, which is here to stay.

The increase in people cooking at home, which has been brought about by the pandemic, has changed from a necessity to a choice. The growth is driven by two factors: 91.6% of people surveyed think that, when out of the pandemic, they will continue cooking at home as a way of saving money, while 85% will do it to keep themselves entertained. When we consider reasons for consumption, “pleasure” is at the same level as it was in the middle of lockdown, with some new types of occasion (that cover very different needs and emotions) offering manufacturers and retailers new opportunities for growth.

It is equally important to highlight that 29.5% of Spanish homes suffered a significant reduction in their income, so brand managers should also include a range of products and formats that are suited to their financial needs.

Transformation of the retail sector: Spaniards are shopping less

With respect to the challenges facing the retail sector, the pandemic has had a big impact on shopping. Some of these changes are here to stay, such as the increase in ecommerce, which since the pandemic has settled at a level of around 3%, or the boom in meal delivery, which has broken down barriers and opened the way for new business models.

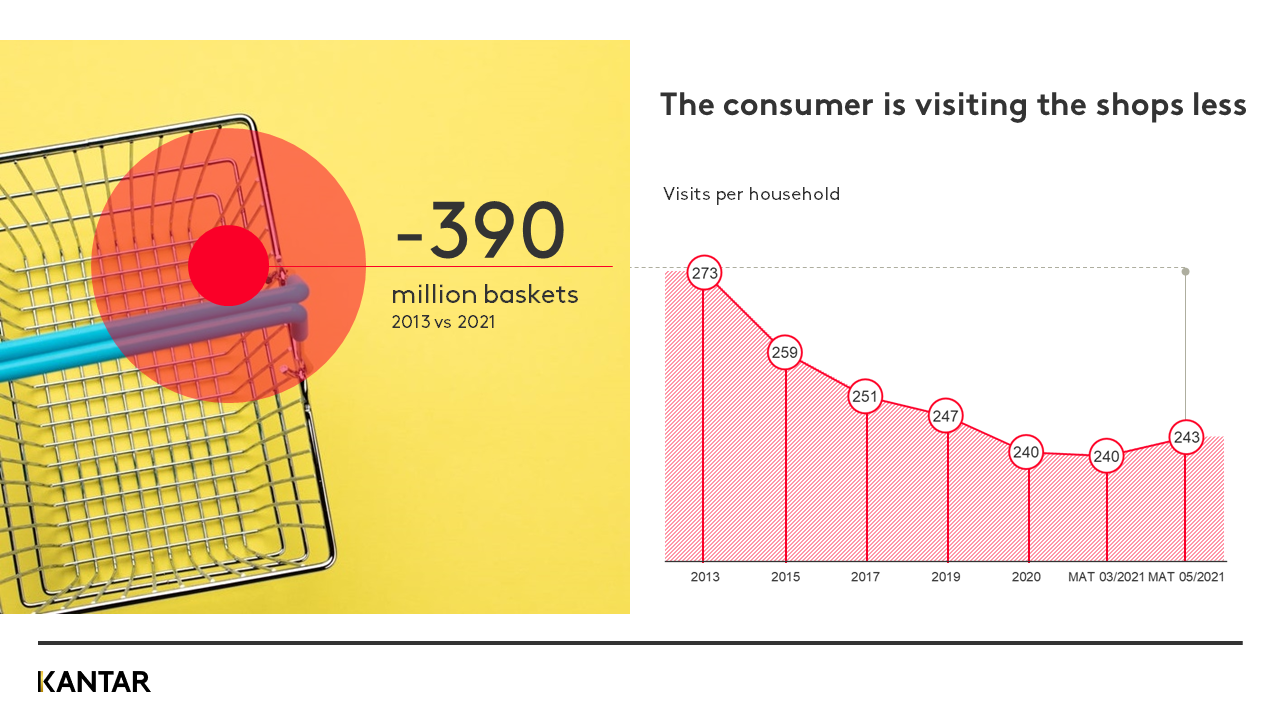

The main change, that was already taking place but has been accelerated by the pandemic, is that Spaniards are shopping less: 390 million fewer baskets per year, based on data from 2013 to 2021. This change, with a large impact on both manufacturers and retailers, is caused mainly by the move towards organised distribution, the development of ecommerce, lifestyles and household types.

One of the main challenges facing retail is to keep as many shoppers as possible. There are no truly loyal customers: only 7% of buyers spend the bulk of their budget on one supermarket, a percentage that is decreasing year on year. If we take this into account, increasing penetration or visits by consumers is the most effective way of gaining baskets. It is also important to note that penetration by category is the way to monetise incoming buyers. The more category penetration you achieve, the easier it will be to ensure the next basket is filled within your supermarket.

For manufacturers, people visiting the store less also affects the likelihood of having an impact on the shopper. Conversion at the point of sale is something that retailers and manufacturers must work on together.

Focusing on the ‘non-shoppers’

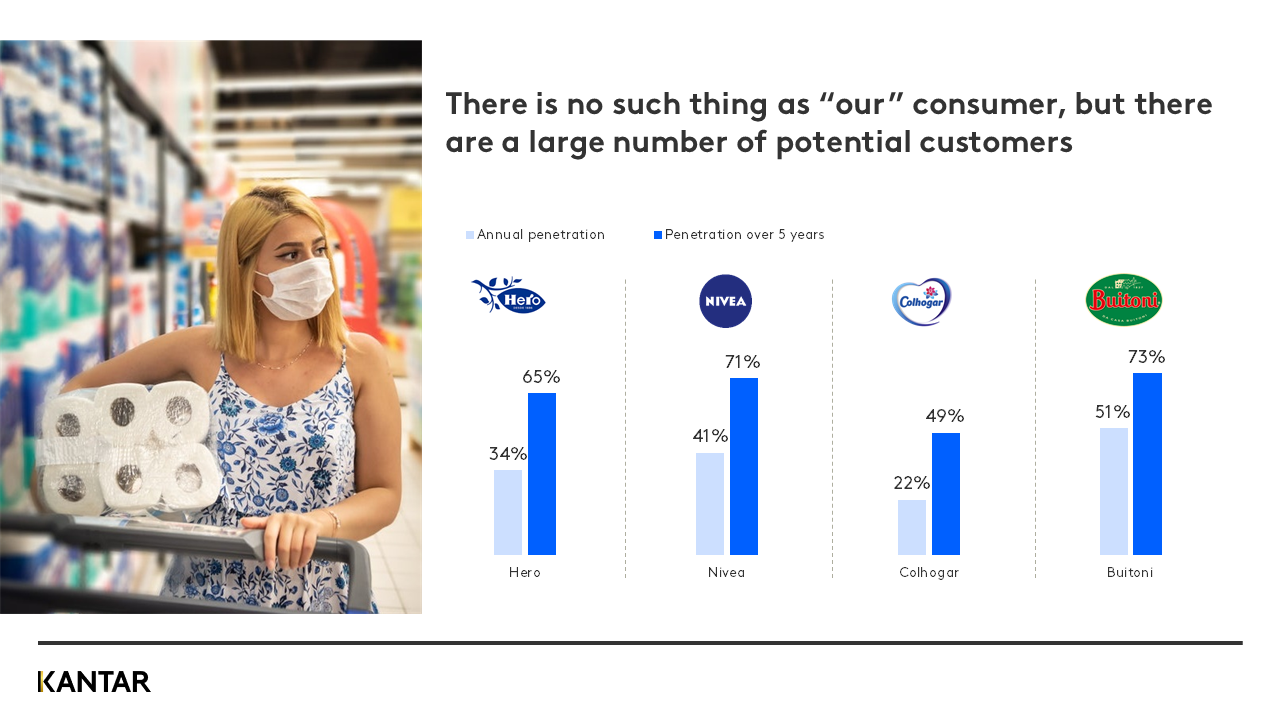

How do shoppers actually make decisions? Despite habits changing during the pandemic, the fundamental rules for growth are still the same in Spain and everywhere else: you must attract new buyers. The latest data shows that consumers of a product continue to switch brands more frequently than we would expect. This could be a great opportunity for brands, because although there is no such thing as ‘our’ consumer; there are a large number of potential customers: the ‘non-consumers’. Brands should focus on light consumers, those who buy a brand very occasionally, because they are the ones who determine long-term evolution.

In the analysis of ‘non-buyers’, we see four main reasons why consumers do not buy a brand:

- they have not heard of it or do not think about it;

- they do not see it or cannot find it;

- the brand is not relevant to them or does not suit them; or

- they think it is too expensive.

Furthermore, these reasons can be cross-referenced with three main groups of ‘non-buyers’ – the uninformed, the distracted and the conscious – to draw different conclusions:

- Advertising campaigns should focus only on ‘non-buyers’, such as the uninformed and distracted, for the greatest impact.

- The physical shop is critical for the short term, as 80% of a light user’s possible business is done at the point of sale.

- 90% of the potential for the conscious ‘non-buyer’ is about the product and therefore it is key to focus on long-term innovations.

Finally, for the potential buyers who make their purchase decision at the point of sale, there are some specific barriers or incentives that could affect this decision: presence in the store, location on the shelf, assortment, innovation, format, price or promotion, among others.

If you would like to learn more, please contact our experts.