Consumers around the globe spent 11% more on snacks and non-alcoholic drinks to enjoy away from home in Q3 of 2023 than they did the previous year. This is a continuation of the slow recovery trend we have witnessed since the inevitable drop in 2020. In two markets in particular, however, value growth is huge – and this is a result of more than price rises.

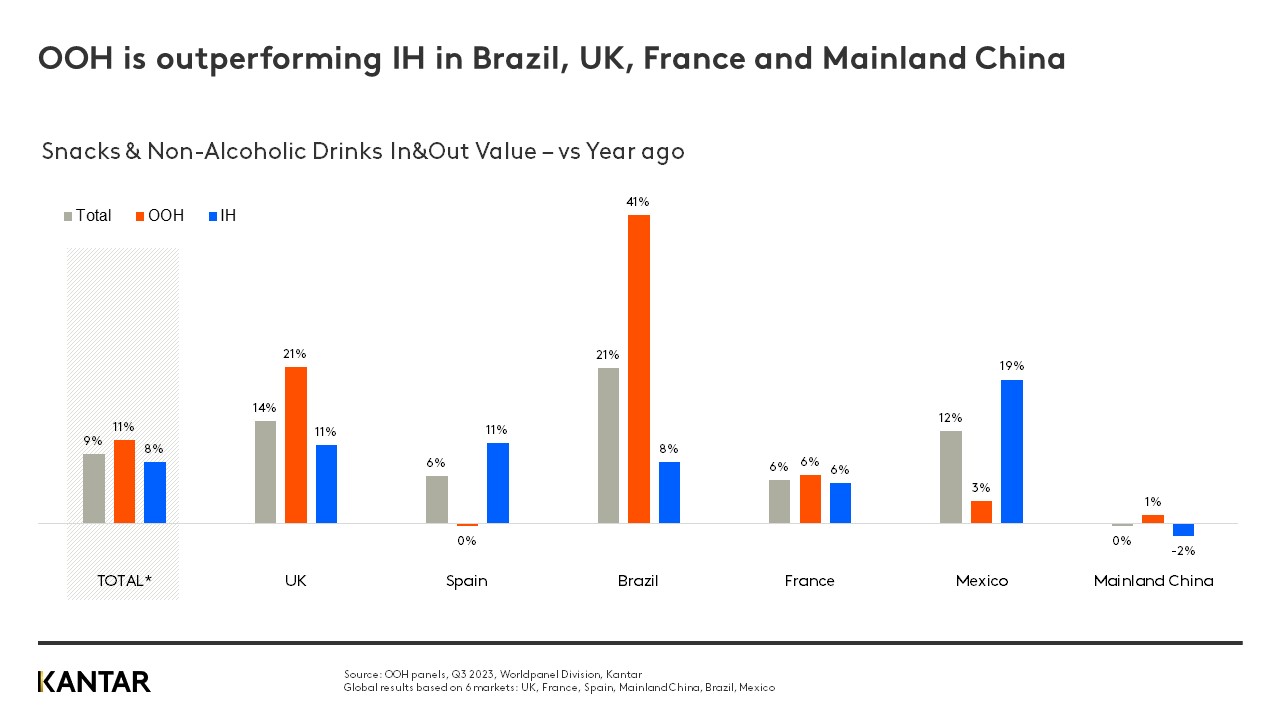

Looking at the big picture, total spend on snacks and non-alcoholic drinks across both the out-of-home (OOH) and in-home (IH) spheres has grown once again, for the tenth quarter in a row, with a 9% year-on-year increase.

If we dissect the market, OOH value sales have grown faster than in-home spend during 2023, with a rise of 11% ($6.8bn) from $16.4 billion in Q1 to $23.2bn in Q3. This surpassed the 8% in-home value increase of $6.6bn, to reach $37.7bn.

The OOH sector is particularly dominant in Brazil, where growth reached a huge 41% in Q3, versus 8% for in-home, and in the UK, where the 21% boost in OOH value was double that stemming from in-home purchases (11%). Only in Spain and Mexico does the needle swing in the direction of the in-home sector.

Growth is organic

When we delve into the context surrounding the growth of OOH snacks and drinks, some positive news emerges. The ‘price effect’ created by inflation is only responsible for one third of the increase in spend in the UK: 7% of the overall 21% rise. This indicates that the value growth is linked to a real and natural expansion in the number of trips consumers are making.

Even in Brazil, where OOH grew 41% in Q3 of 2023 versus the same period in 2022, price rises account for just 45% of that total growth; the biggest contributor is the recovery in trips taken and the number of units bought per trip.

Proportion remains off-course

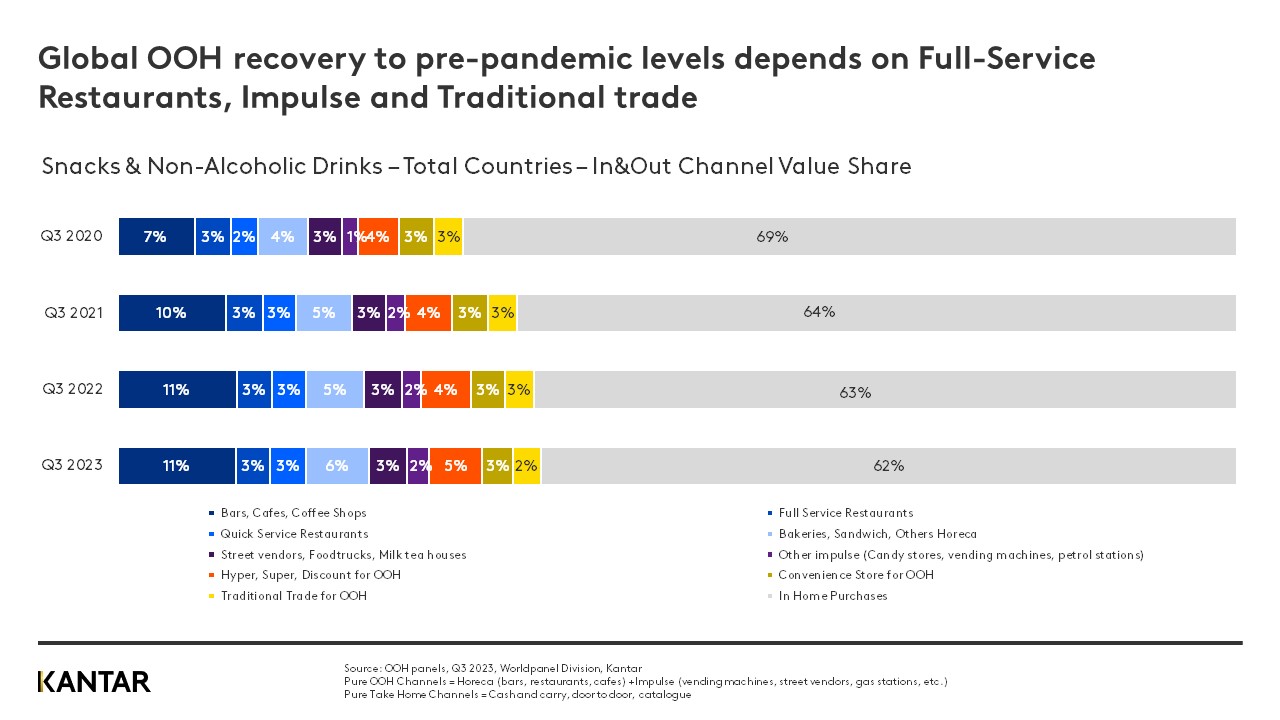

However, despite this strong – and continually strengthening – performance, the balance between OOH and in-home sales of snacks and drinks has still not quite righted itself to pre-pandemic levels. OOH purchases today contribute 38% of the total market value, whereas in Q3 of 2019 the figure was 41%.

Horeca is almost back to normal

A crucial channel for OOH recovery, the share of overall spend in hotels, restaurants and cafes (horeca) has remained steady at pre-Covid levels for the second consecutive quarter. The ability of the OOH market as a whole to fully recoup its pre-pandemic value is now highly dependent on the fortunes of the full service restaurants, impulse and traditional channels.

Snacks overtake drinks

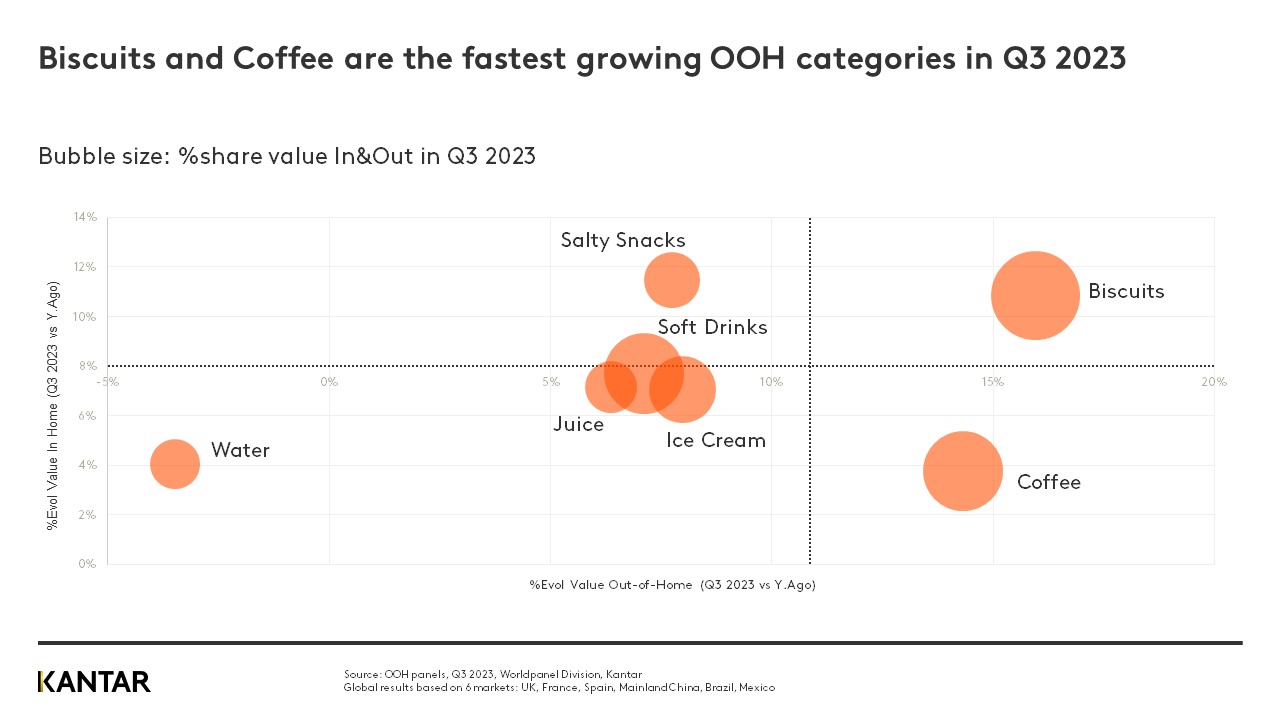

The fastest value growth across the OOH sector can now be seen in snacking food, with a 15% rise compared with 10% for non-alcoholic drinks.

Biscuits and coffee are currently the strongest categories, with rapid growth of 14% and 12% respectively. This trend is likely to be linked to the resurgence of coffee shops, bakeries, and impulse channels, where these items are most commonly sold.

The proportion of overall OOH value that comes from sales of biscuits and cakes has now reached 41%, up from 39% in 2021, largely driven by consumers in the UK and Brazil.

As we enter 2024, the OOH landscape – in terms of geographies, channels and categories – will continue to readjust following the transformation triggered by the pandemic. Inflation is an ongoing challenge, while consumers keep on building new habits and routines.

Snacks and drinks brands need to consider questions such as:

- How will the cost-of-living crisis impact OOH this year?

- What is the right pricing strategy for our product, channel by channel?

- How can we push volume up across different occasions?

Find out more about the OOH global snacks and non-alcoholic drinks market by downloading the full Out-of-Home Barometer through the form below, or reaching out to our experts.