Worldpanel’s latest Entertainment on Demand (EoD) data on the UK streaming market uncovers the following behaviours within the Video on Demand (VoD) market between January to March 2024.

The findings from Q1 highlight contrasting strategies and outcomes among the leading streaming services. For instance, Prime Video's introduction of an ad-supported tier was met with significant resistance, leading to a notable subscriber exodus and dissatisfaction. In contrast, AppleTV+ and Netflix have successfully engaged and retained their audience, with strong content offerings and stable performance metrics. These dynamics underscore the challenges and opportunities within the evolving SVoD market, where consumer preferences and responses to pricing and advertising strategies can significantly impact business performance. Wordpanel's EoD study in Great Britain uncovers the following key behaviours within the Video on Demand (VoD) market between January to March 2024:

- Prime Video suffers as subscribers’ push back after being asked to pay more to avoid ads

- AppleTV+ held onto its top spot in terms of share of new SVoD subscriptions in Q1 of 2024 with 16% share

- Disney+ took 2nd spot in share of new subscriptions with historical drama, Shogun, performing strongly

- Netflix is the go-to destination for inspiration on what to watch next, as 52% of all British SVoD subscribers search Netflix first for new content

- 19.9m British households have at least one paid video streaming service in their household, virtually flat vs. the previous quarter (Q4’23)

Prime Video endures a tough first quarter after new ad supported tier introduction

Prime Video is the streaming service most impacted by seasonality, often seeing a drop in Q1 following a peak in Q4 driven by Christmas period Prime membership spikes. However, Q1 this year was particularly tough.

As from 29th January, Amazon introduced ads to its video streaming service, requiring existing subscribers to pay an additional £2.99/month to remain ad free. The response was hundreds of thousands of subscribers ditching the service immediately. Key metrics, including share of new subscribers, total number of subscribers and proportion of Prime users engaging with Prime Video all fell significantly in the first quarter of 2024. Subscriber advocacy, as measured by Net Promoter Score, was the lowest it’s been in over 3 years.

The subscriber churn rate as measured in January 2024 was the highest for Prime Video measured by the Worldpanel study since it began in 2020.

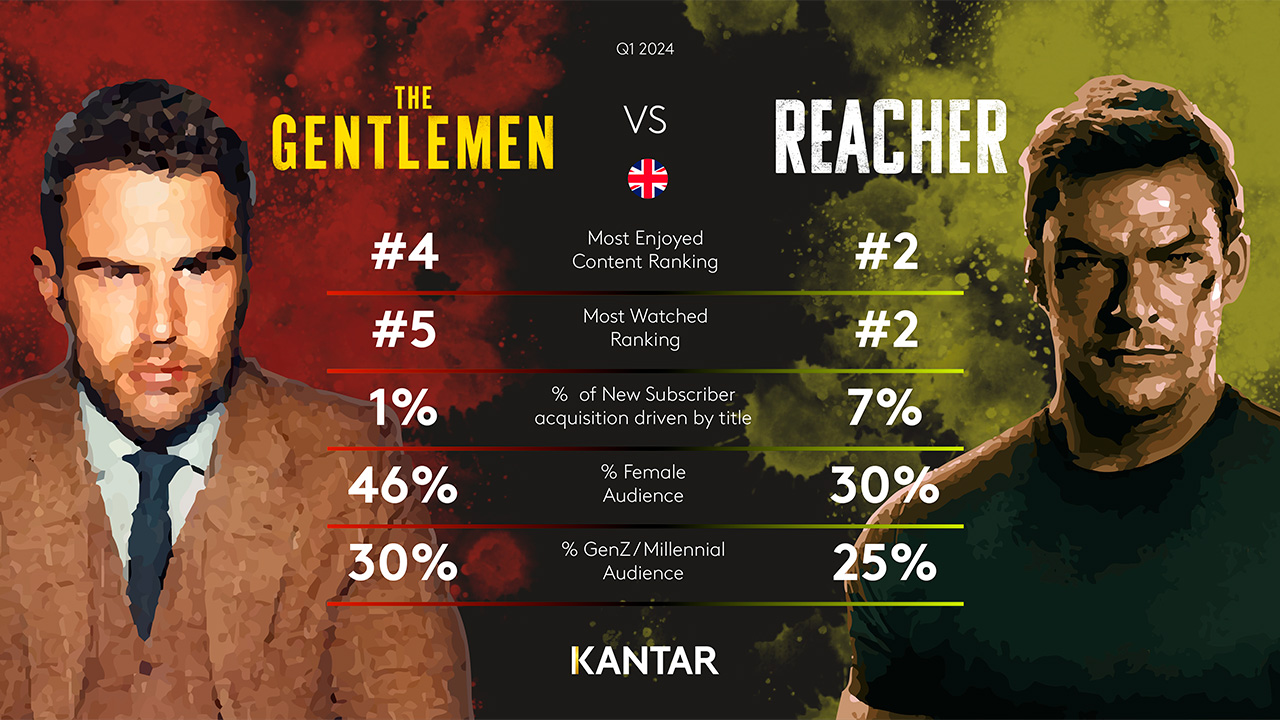

Despite other high profile streamers introducing ad-tiers, Prime Video is the only major service whose subscribers display an active net dissatisfaction with the number of ads being served. The only positive was that Reacher made it as the #2 most enjoyed show over the quarter with the much talked about Saltburn coming in at number 8.

AppleTV+ #1 for second consecutive quarter in share of new SVoD subscriptions

After reaching its highest ever share of new SVoD subscriptions during Q4 2023, AppleTV+ held onto top spot in the first quarter of the year with 16% of market share. Slow Horses & Ted Lasso continue to act as a strong catalyst for attracting new subscribers, whilst WW2 series Masters of The Air accounted for 12% of new title driven subscriptions. Almost half of AppleTV+ new subscribers joined to view a specific title in the quarter. AppleTV+ is managing to reach a far wider audience than seen previously, with the majority of its subscriber gains seen in the 45–54-year-old age bracket, reducing its previous heavy reliance on younger audiences. Free trials continue to bolster AppleTV+ numbers, but the proportion paying for the service has risen for the last 9 months. There are signs churn rates are being managed more effectively, with a decline seen every month throughout Q1 2024.

Guy Ritchie’s ‘The Gentleman’ captivates Brits

The Gentleman on Netflix has proved to be a major hit for the streaming platform, as both the most watched and most enjoyed SVoD title during March. Netflix saw a strong quarter of new subscriber additions, holding 15% of all new SVoD additions in the first quarter, a +5% rise vs. the previous quarter. Netflix churn remained steady in the quarter and the lowest in the category. Customer advocacy at Netflix continues to build, and it remains in top place since overtaking Disney+ in Q3 2023.

Netflix is the go-to destination for new viewing inspiration

Despite significantly increased competition in the British SVoD market, one of Netflix’s strongest but least talked about superpowers, its place as the first destination consumers go to discover new content, remained as strong as ever over the year. Moreover, 52% of all British SVoD subscribers go to Netflix first when they are looking for inspiration for something new to watch, up 1% vs. the same period a year ago. Significantly, 60% of Netflix subscribers who have multiple SVoD services in their household consider it to be their most important service, +1% vs. a year ago.

"In the first quarter of 2024, we've seen stark contrasts in strategy and subscriber response among major players. Prime Video, for example, faced significant challenges as it introduced an ad-supported tier, resulting in notable subscriber churn and dissatisfaction. In contrast, AppleTV+ has successfully held onto its leadership in new subscriptions, driven by compelling content and an expanded demographic reach. Netflix continues to excel as the first port of call for British consumers seeking new and engaging content, with strong subscriber retention and growth. These trends underscore the critical importance of understanding consumer preferences and the impact of service changes on subscriber behaviour and market positioning," said Dominic Sunnebo, Global Insights Director at Worldpanel.

Access the interactive data visualisation for more information.