Worldpanel’s latest Entertainment on Demand (EoD) data and analysis on the UK's streaming market shows that AppleTV+ achieved the highest share of new subscribers thanks to a winning strategy of free trials powered by the success of British shows Slow Horses and Ted Lasso to attract new subscribers. AppleTV+ seized the top spot from Disney+ in new SVoD subscriptions during Q4'23, commanding an impressive 18% share.

Key takeaways from Kantar's Entertainment on Demand (EoD) study, from October to December 2023, include:

- 39% of new subscribers of AppleTV+ cite free trials as a significant factor for using the service.

- Subscribers rate the quality of content on AppleTV+ higher than any other major service.

- Prime Video took second spot in share of new subscriptions in Q4 with a 16% share.

- The data reveals that 19.8m British households have at least one paid subscription video on-demand (SVoD) streaming service in their household, flat vs. Q3’23.

Commentating on the study's findings, Dominic Sunnebo, Global Insight Director, Worldpanel Division, Kantar, said: “The remarkable surge in AppleTV+ subscriptions during Q4'23 underscores the undeniable appeal of British TV shows which had strong impact on AppleTV+’s new subscriber figures. Slow Horses and Ted Lasso drove almost 30% of new subscribers exemplifying AppleTV+’s commitment to delivering top-notch content that resonates with regional audiences."

AppleTV+ ranks #1 thanks to Slow Horses and Ted Lasso success

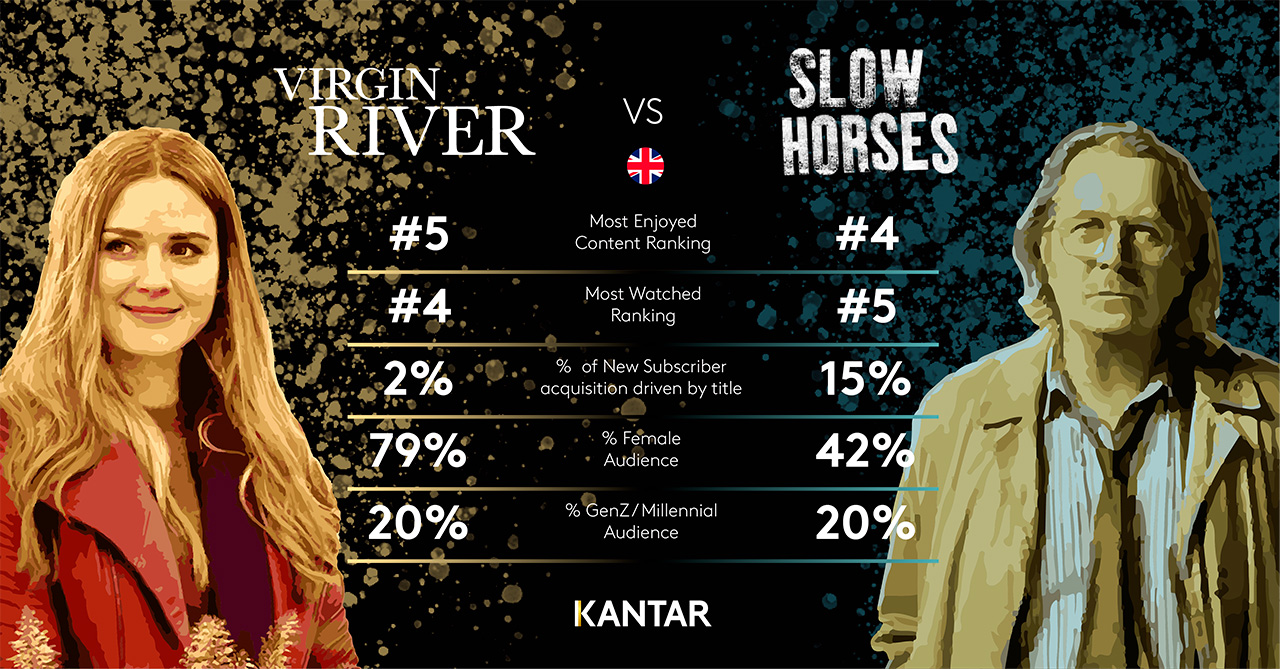

AppleTV+ reached its highest-ever share of new SVoD subscriptions during Q4'23, thanks to the success of British hits Slow Horses and Ted Lasso. Slow Horses, starring Gary Oldman, secured the 4th spot in December's most enjoyed titles across all SVoD, trailing the final instalment of The Crown on Netflix, which claimed the top spot. Notably, 36% of all new AppleTV+ subscribers joined explicitly to watch a particular series or film, showcasing Apple's commitment to content quality over quantity.

Despite ranking lower than Netflix and Disney+ in the volume of original content, AppleTV+ subscribers consistently rate the quality of its content higher than other major services. Free trials remain a crucial tool for Apple in acquiring new subscribers, with 39% of new joiners in the quarter citing free trials as a significant motivating factor.

While AppleTV+ continues to attract new subscribers, and experiences, overall growth in subscriber count, there's a persistent battle with high churn rates – planned cancellations for the next quarter hit 15% among AppleTV+ subscribers vs 3% for Netflix.

Netflix closes the year strong with The Crown's finale

The success of the final instalment of The Crown, despite receiving mixed reviews from critics, significantly contributed to Netflix's strong performance in the last quarter of the year in Britain. Netflix saw a 1%-point increase in its share of new SVoD subscribers, reaching 10.6%, and The Crown emerged as the highest rated SVoD series (14%) across the country. Netflix also secured the highest rating in subscriber advocacy, surpassing Disney+ and reclaiming the lead. With churn rates low and stable and planned cancellations for next quarter falling, the platforms reign is not going away anytime soon.

Disney+ promotion effect subsides

While Disney+ experienced significant subscriber growth in Q3, fuelled by its £1.99 for three months campaign, the impact of this promotional effort has begun to diminish. Last December, churn rates spiked as viewers, initially attracted by promotions, scaled back their subscriptions. 13% of those who cancelled their Disney+ subscriptions over the Christmas period attributed their decision to a price increase, while 29% mentioned infrequent use of the subscription as a key reason. Despite this, Disney+ maintained a respectable 14% market share, securing the 3rd position in terms of new SVoD subscribers for the quarter. The series Loki also performed well, ranking as the third most enjoyed title over the quarter.

Yellowstone continues to deliver for Paramount+

The global western hit Yellowstone continued to play an essential role in the Paramount+ growth story in Britain. Almost half of new Paramount+ subscribers cited a specific title as the reason to join, with 18% mentioning Yellowstone. The Sky partnership is performing well for Paramount+, with almost 1 in 3 Sky subscribers joining Paramount+, a share more than double that of the wider population. Lastly, four consecutive months of reduced churn indicate a more stable footing for the service going forward.

Access the interactive data visualisation tool for more information and reach out to our experts for further insight.