Key Takeaways

- Effective surveys start with clear intentions and a defined target audience.

- Good survey questions are mobile-friendly, concise, unbiased, and engaging.

- Choose the right question type to match your research goals, such as open-ended, multiple choice, rating scale, Likert, or matrix.

- Strong survey design includes visual appeal and mobile optimisation to reduce dropout rates.

- Always test your survey before launch to ensure clarity, flow, and data accuracy.

- Explore survey question examples and templates to save time and collect higher-quality insights.

Surveying is a powerful tool in your market research toolbox. The resulting data can give you a better understanding of consumers, allowing your company to make informed business decisions. But alas, no one said conducting an effective online survey was easy. Below, we explore the best practices of questionnaire design while presenting turnkey solutions that simplify and streamline the survey design process.

Why survey questions matter

Even in a data-rich, AI-driven world, surveys remain one of the most reliable ways to understand people’s perceptions, motivations, and behaviours. For customer satisfaction, employee engagement, or market research, well-designed surveys capture the “why” behind the data and provide insights that algorithms alone can’t reveal.

Every successful survey begins with a clear purpose. Defining the core decision your research should inform helps anchor every question you ask. Using a single “North Star” KPI such as Net Promoter Score (NPS), satisfaction, or concept appeal keeps your scope focused and ensures the data you collect is actionable.

The quality of your questions directly determines the quality of your insights. Well-crafted questions eliminate response bias, uncover motivations, and improve decision-making. Clarity reduces random responding and nonresponse, while neutral language increases both validity and comparability across segments and markets.

Global research leaders like Kantar turn survey data analysis into strategy. Through Kantar Profiles, organisations gain access to expertise in survey design optimisation, audience recruitment, panel management, and fieldwork execution. This ensures data accuracy, speed, and reliability so every research initiative delivers insights you can trust to guide confident decisions.

How to conduct a survey

Before getting into the how-tos, it’s helpful to start with the basics. What are online sample surveys?

Online sample surveys are questionnaires that are sent to a sample of individuals from your target population (aka target audience). An online survey offers invaluable insight into consumer opinions, preferences, and purchasing behaviours. However, conducting a questionnaire that yields valid and reliable data requires a meticulous approach.

Before you can begin firing off questions, you must determine your intentions and target audience. What do you want to learn more about and from whom? A company may, for example, want to assess laundry detergent brand awareness among millennial consumers.

After establishing this baseline, you must write the questions. Though this sounds simple enough, crafting effective survey questions is equal parts art and science. These prompts must be clear and concise to avoid survey dropout, straightlining, and other practices that contribute to dubious data. However, the questions must also offer the depth needed to make meaningful observations.

Additionally, market researchers must select the appropriate question type for the situation. Misusing a Likert scale, for instance, could result in tainted data. Meanwhile, overusing open-ended questions could tempt participants to enter gibberish that’s not in the least bit helpful.

What makes a good survey question?

Thus far, we have alluded to what constitutes a bad survey question: bias, verbose language, repetition, and so on. But what makes a good survey question?

1. Mobile-friendly

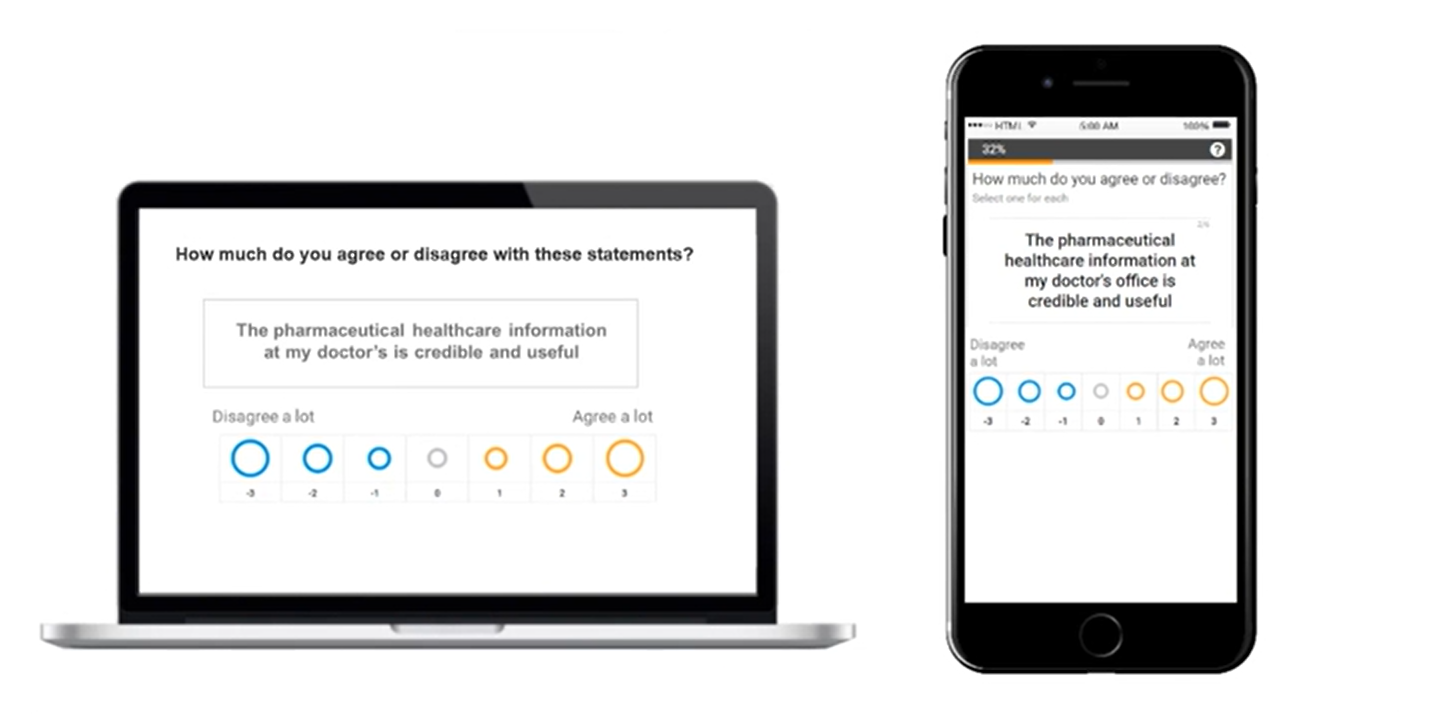

Consumers crave a fast, frictionless experience. That means survey questions must, above all, be screen agnostic. All the answer choices should fit on a mobile screen, for example.

2. Short and succinct

Attention spans are waning. As a market researcher, you often have less than 10 minutes to engage survey participants. If your questions are too long or too confusing, consumers might drop out or give unreliable answers by straightlining, speeding, or random question answering.

3. Fun and engaging

The more tedious your survey, the less reliable your data. It’s that simple. So, your goal as a market researcher is to make your questionnaire as fun and engaging as possible. Can you incorporate iconography? Casual language? Meaningful questions consumers actually want to answer?

4. Unbiased

If you want to collect data that will help your company make informed decisions, survey questions must be free and clear of leading questions, loaded questions, double-barreled questions, and other types of bias.

5. Meaningful

Survey dropout is sure to skyrocket if you ask the same question or a similarly-phrased question repetitively. Ergo, make sure to ask meaningful questions once and only once.

Types of survey questions

The significance of selecting the right type of survey question is often overlooked. This is unfortunate because choosing an unsuitable question type can contribute to response biases that spoil your data. The corollary, of course, is that you can optimise your survey data by opting for questions that suit the framework of your survey.

Generally speaking, there are five different types of survey questions:

1. Single and multiple choice questions

Single and multiple choice questions are examples of close-ended questions. Meaning, there are a finite number of responses. The difference between the two is that with single choice questions, participants can only select one option. Comparatively, multiple choice questions are characterised by numerous options.

Single and multiple choice questions are among the most commonly used types of questions because they are quick and simple to answer. However, one downside is that the data yielded is purely quantitative.

Pros

- Quick and simple to answer

- Mobile-friendly

- Easy to analyse

Cons

- Time-consuming to generate

- Yield purely quantitative data

- Limited responses

2. Open-ended questions

Open-ended questions are prompts that cannot be answered with a simple ‘yes’ or ‘no.’ These questions are explanatory in nature and yield rich qualitative data by way of free-form text responses. This qualitative information can be used as is or transmuted into quantitative data via word clouds and other tools.

Open-ended questions do have a downside, however. Namely, they are time-consuming to answer. Because of this, if your questions aren’t engaging, and you use too many, you might not collect the quality you can expect.

Pros

- Unlimited responses

- Richer, deeper data

- Offers insight into the customer journey

Cons

- Time-consuming to answer

- Yield unusable responses (i.e., emojis, gibberish, URLs)

- Difficult to analyse without the proper tools

3. Rating scale questions

Rating scale questions present participants with a spectrum of answer choices pertaining to a specific theme. A popular example is a rating scale that assesses a consumer’s likelihood to purchase a product again, with 1 representing ‘very unlikely’ and 5 representing ‘very likely.’ Frequency is also commonly assessed with rating scale questions.

Rating scales are helpful because they allow market researchers to quantify subjective sentiments. The disadvantage is that rating scales are inherently subjective. Different participants often have different interpretations of vague verbiage like ‘sometimes’ or ‘very likely.’

Pros

- Quantify subjective sentiments

- Easy to understand

- Affords simple analysis

Cons

- Answer options are vague

- Error of central tendency (participants tend to select the midpoints of the scale)

- Limited options

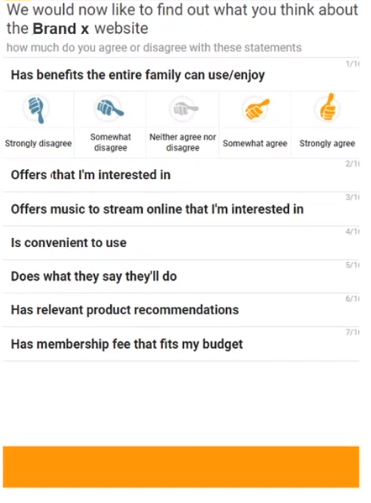

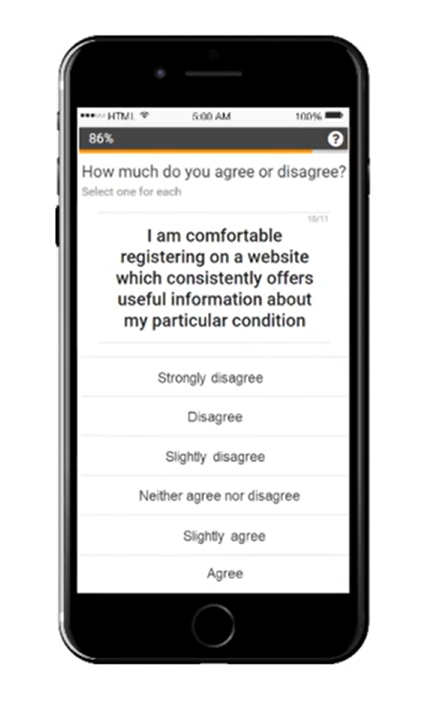

4. Likert scale questions

Likert Scale questions are those that employ a five- to seven-point scale in an attempt to quantify subjective sentiments. These questions are very similar to rating scale questions, but with a few important differences. Namely, a rating scale can consist of any number of choices while Likert Scale questions tend to offer either five or seven options.

Likert Scale questions are quite popular because they afford more granularity than binary questions. However, since market researchers generate the responses, these questions can be susceptible to leading bias.

Another issue is that respondents can find Likert Scale questions repetitive and fatiguing, leading them to lose concentration and not carefully consider their answers. Try to keep banks of such questions to ten iterations or less if possible.

Another problem with Likert Scale questions is mobile responsiveness. Oftentimes, seven answer choices cannot fit onto a small smartphone screen. As a result, the text is cut off, completely skewing the data yielded from the survey. Ergo, if you’re going to use Likert Scale questions, it’s a best practice to opt for five answer choices.

Pros

- Quick to complete

- Very popular question type

- Effective tool for gauging satisfaction

Cons

- Susceptible to leading bias

- Subjective answer choices

- Limited responses

- Repetitive

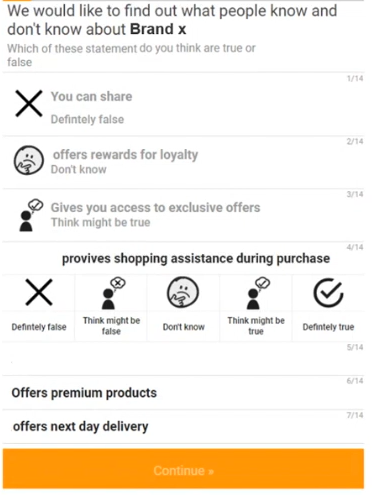

5. Matrix/grid questions

Matrix/grid questions group several multiple choice questions together in a grid of rows and columns. The first row presents the various questions while the column headers present the answer choices.

Since matrix/grid questions group multiple questions together, it gives survey takers the illusion of a single question. This offers the benefit of saving space and reducing survey dropoff. (Respondents would rather answer a single question than five different questions.)

However, it’s critical to understand when and when not to use matrix/grid questions. Why? Because these questions are often incompatible with smart devices. Because of this, surveys with matrices/grids often have a high dropout rate.

Pros

- Saves space in survey layout

- Reduces perceived survey length

- Enables easy comparison of items

- Simplifies pattern and trend analysis

Cons

- Poor mobile compatibility

- Can feel repetitive or tiring

- Risk of straightlining responses

- Harder to interpret incomplete data

5 tips for designing a survey

If you want to design a survey that yields valid and reliable data, consider these five tips.

1. Determine your intentions

Before you conduct a sample survey, you must determine what information you hope to ascertain. Do you want to gauge consumers’ brand loyalty? Or are you conducting ad testing? Your intentions will affect the type of questions you ask.

2. Identify your target population

Next, you must identify your target population. Your target population consists of the individuals or businesses to whom you hope to sell products or services. For example, the target population for a software developer that sells small business software would be small business owners and finance professionals.

Since culling a group of willing participants can be quite time-consuming and expensive, many companies collaborate with market research partners. Kantar Profiles, for example, offers access to an exclusive network of 169 million research-ready respondents who have passed quality checks to eliminate fraudulence.

3. Choose the appropriate question type

As previously noted, choosing the right type of question can mean the difference between valid and invalid data. If, for example, you overuse open-ended questions, you could end up with a glut of gibberish answers. Comparatively, if you exclusively employ single choice questions, your survey probably won’t offer much insight into your target audience.

4. Consider the design elements in your survey

How your survey looks matters just as much as its content. Namely, if you don’t design a survey for mobile, you will see high rates of survey dropout. The responses you do collect won’t be representative of your target population.

Beyond mobile usability, the aesthetics of your survey can make or break engagement. Consider this as an example: One survey uses a small, illegible font and no iconography. Another employs large, easy-to-read writing and graphics. Which survey would you rather take?

5. Test your survey

Before you send your survey out to consumers, it’s important that you test it. This step need not be complicated. You can simply ask two to three colleagues to review the form. Afterward, ask for feedback. How long did it take for them to complete the questionnaire? Did all of the questions make sense? Was the format easy to follow?

Hearing from people you know can be a good reminder that actual human beings will be completing your survey—a realisation that underpins empathetic survey design.

Where and when to ask survey questions

Outline placement strategy by journey stage

Choosing the right time and place to ask survey questions is key to collecting accurate and meaningful feedback. Align your survey placement with the customer or user journey to ensure relevance and higher response rates.

For example, ask short satisfaction questions right after a completed action such as checkout or sign-up. Use quick feedback prompts on pricing pages to understand hesitation, and trigger exit surveys to capture why users did not complete a process.

Demonstrate timing logic

Timing determines the quality of the feedback you receive. Collect responses immediately after key interactions so participants can share context-rich insights while the experience is still fresh.

For example, trigger NPS or satisfaction surveys after a customer completes a purchase, uses a product feature, or finishes a support call. Gathering input at the right moment ensures responses reflect real experiences instead of delayed perceptions.

Best practices for writing effective survey questions

Before respondents begin, make sure they understand the survey’s purpose and how their input will be used. Clear intent builds trust and improves response quality.

Explain clarity tactics

Provide short guidance such as “Consider your most recent experience” before each question to set expectations. Keep phrasing simple, specific, and easy to interpret.

Highlight neutral wording and single-topic focus

Use neutral, unbiased language that avoids steering participants toward a certain response. Focus each question on one idea. For example, replace “How helpful and fast was support?” with two questions: one about helpfulness and one about speed.

Pilot and revise

Test your survey with five to ten people to identify confusing wording or timing issues. Use their feedback to refine question clarity, response options, and flow. Adjust rating scales or answer choices as needed based on pilot results.

Demonstrate mobile-first design

Design with mobile users in mind. Limit matrix questions, reduce the number of open-ended responses, and minimise scrolling. This ensures the survey experience is quick, accessible, and user-friendly across devices.

Outline question order strategy

Start with easy, non-sensitive questions to build engagement. Place demographic questions at the end to reduce early drop-off. Group related questions by theme to create a logical, consistent flow that keeps participants focused.

For more tips and detailed guidance, explore survey best practices.

Survey question examples

When optimising a survey, it can be helpful to see sample survey questions. These examples can act as a guide, providing insight into how to structure different types of survey questions.

Single and multiple choice questions

Example A

Out of the options below, which automobile manufacturer do you consider the most reliable?

- Toyota

- Volkswagen

- Ford

- Mercedes-Benz

Example B

Which of the household cleaning product brands do you use on a daily basis?

- Windex

- Clorox

- Mrs. Meyer’s

- Lysol

Open-ended questions

Example A

How does Product X make you feel?

Example B

What steps do you take to research a product before buying it?

Rating scale questions

Example A

How likely are you to recommend Product X to a friend on a scale of 1-5?

Example B

Likert scale questions

Example A

How strongly do you agree with the following statement: ‘The payment process at Company X is simple and easy.’

- Strongly disagree

- Somewhat disagree

- Neither agree nor disagree

- Somewhat agree

- Strongly agree

Example B

How satisfied were you with your customer service?

- Very dissatisfied

- Somewhat dissatisfied

- Neither dissatisfied nor satisfied

- Somewhat satisfied

- Very satisfied

Example C

Matrix/grid questions

Example A

Example B

Survey question examples across use cases

Customer feedback surveys

Align survey questions with key stages of the customer journey. Map each question to awareness, consideration, purchase, and post-purchase phases to understand how perceptions evolve.

Include metrics such as NPS, satisfaction, and effort scores to measure loyalty and experience quality. Pair NPS questions with an open-ended item like “Explain your score” to capture deeper insights behind the rating.

When reporting, display trend lines over time, segment comparisons, and key drivers to highlight where improvements have the most impact.

Market research surveys

Focus on demographics, product usage, attitudes, and unmet needs to understand audience segments. Use nominal questions for profiling and ranking questions for preference measurement.

For concept testing and pricing research, apply rating scales to gauge appeal and purchase intent, followed by short open-ended “why” or “why not” questions to uncover reasoning.

Segment results by key audience variables such as age, region, or behavior to reveal opportunities for growth and differentiation.

Usability and UX testing surveys

Combine behavioral data with attitudinal feedback for a complete understanding of the user experience. Use tools such as click maps, task-completion ratings, and short open-ended questions like “Explain what was confusing.”

Prioritise fixes by ranking pain points based on frequency and severity to identify the most critical usability issues to address first.

Common pitfalls to avoid in survey design

Avoid leading, loaded, and ambiguous wording by rewriting for clarity. Replace “How great is our customer service?” with “Explain how satisfied you are with customer service.”

Prevent fatigue by keeping surveys under seven to ten minutes and removing non-essential or “nice-to-know” questions.

During exploratory research, limit early use of closed-ended questions. Begin with one or two targeted open-ended items to capture authentic insights.

Use scales correctly by aligning endpoint labels with the question’s intent and maintaining consistent directionality to avoid confusion.

Turning questions into strategic insights

Great surveys uncover the insights that drive smarter decisions. By starting with clear objectives and designing every question with purpose, organisations can turn feedback into a foundation for meaningful action.

Balancing research rigor with an engaging respondent experience ensures every response is accurate, representative, and ready to inform strategy. A test-and-learn approach keeps surveys agile, allowing teams to refine methods and improve outcomes over time.

The most impactful insights come from partnership. Begin with a focused pilot, expand through scaled fieldwork, and collaborate with Kantar for expert-led design, advanced analysis, and precise market calibration.

Connect with Kantar Profiles to elevate your survey design, strengthen your sampling strategy, and transform data into confident, actionable insights.

Frequently asked questions

What are the main types of survey questions?

The main types include open-ended, closed-ended, rating scale, Likert scale, and matrix questions, each serving different research goals.

Why does wording matter in survey questions?

Clear, neutral wording prevents bias and confusion, ensuring responses are accurate and actionable.

How many questions should a survey include?

Most effective surveys stay short, with five to ten focused questions that align directly with the research objective.

How can survey results be applied?

Survey insights help improve customer experience, increase employee engagement, and inform market research strategies.

Explore the full training video on questionnaire development

A lot of thought goes into crafting a questionnaire. It may need to be an iterative process: from getting at critical questions, to following best practices, to providing a smooth experience for respondents, to considerations for data quality. All together, these actions increase respondent engagement, reduces bias, and encourage honesty.

Watch our 14-minute Online Survey Training Module: How to Create a Questionnaire. There you’ll learn more about the four steps for questionnaire success and additional considerations for creating a survey. Find our full library of video modules here.

Subscribe to learn more

Interested in learning more about designing effective online surveys? Fill out the form below to receive a monthly research tip on online survey design, sampling, and connecting data. You'll also be notified when new Online Survey Training Modules are released.