Grocery price inflation rose again to reach 17.1% in the four weeks to 19 February 2023, the highest level ever recorded by Kantar. Overall take-home grocery sales increased by 8.8% during the four weeks and by 8.1% over the 12-week period.

Shoppers have been facing sustained price rises for some time now and this February marks a full year since monthly grocery inflation climbed above 4%. This is having a big impact on people’s lives.

Our latest research shows that grocery price inflation is the second most important financial issue for the public behind energy costs, with two-thirds of people concerned by food and drink prices, above public sector strikes and climate change. One quarter say they’re struggling financially, versus one in five this time last year. The numbers speak for themselves. If people don’t change how they buy their groceries, households are facing an £811 increase to their average annual bill.

Supermarkets and shoppers are adapting to manage rising prices. The battle to offer best value for consumers continues in this intensely competitive sector, particularly as the traditional retailers look to protect market share from the discounters. Own label ranges have been one obvious focus and shoppers have consistently bought them over brands since February last year. Sales of these lines are up by 13.2% this month, well ahead of branded products at 4.6%, a trend that shows little sign of stopping.

Fruit and veg supply issues

Recently shoppers have also been navigating shortages in the fruit and vegetable aisles. Some supermarkets have been restricting the number of salad and vegetable packs customers can buy due to supply chain issues. Though not captured in this data set, we’ll be closely following the impact of these shortages on sales in the coming weeks. While 43% of all grocery baskets contain at least one fresh produce item, pack limits are unlikely to drastically effect consumers as we usually buy fruit and veg in smaller quantities. For instance, only 1% of tomato purchases last year involved more than three packs.

Despite the wider challenges they’ve been facing, people were still keen to celebrate Valentine’s Day this year. With Valentine’s Day falling on a Tuesday and many feeling the pinch, some shoppers decided to show their love at home this February. Supermarket sales of steak rose by a quarter in the seven days to 14 February compared to the previous week, while chilled ready meal sales were nearly one third higher. Sparkling wine sales also doubled, and an additional £5 million was spent on boxed chocolates. Illness – a Valentine’s gift nobody wants – could also have encouraged at-home celebrations, as sales of cold treatments rose by 82%, cough liquids by 78% and cough lozenges by 70% this month.

Aldi and Lidl collectively increase market share by 2.4%

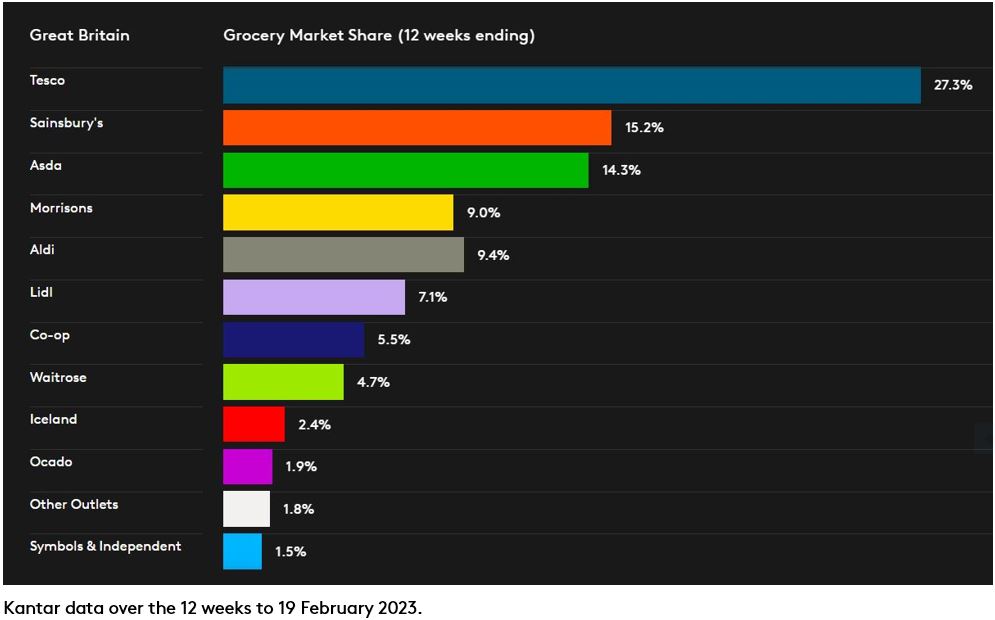

Aldi pushed its market share to a new record this period hitting 9.4%. It remains the fastest growing grocer, with sales up by 26.7%. It was closely followed by Lidl which increased sales by 25.4%. Lidl’s share of the market now stands at 7.1%. Frozen food specialist Iceland also won share, taking 2.4% of market sales, up from 2.3% last year as spending through its tills increased by 10.8%.

Ocado put in a strong performance, bucking the overall trend in online sales. While online fell by 0.9% over the 12 weeks, the digital specialist grew sales by 11.3% to achieve its largest ever market share of 1.9%.

Tesco edged slightly ahead in the battle between Britain’s biggest retailers, with sales up by 6.6%. Sainsbury’s and Asda were just behind with sales rising by 6.2% and 5.9% respectively. Morrisons’ sales decline of 0.9% was its best performance since May 2021.

Waitrose returned to growth, nudging up sales by 0.7%. It has a market share of 4.7%. Convenience retailer Co-op increased sales by 3.4% while independents and symbols were up by 1.8%.

*Kantar pressure groups survey, sample = 9,762, fieldwork 20-30 Jan 2023