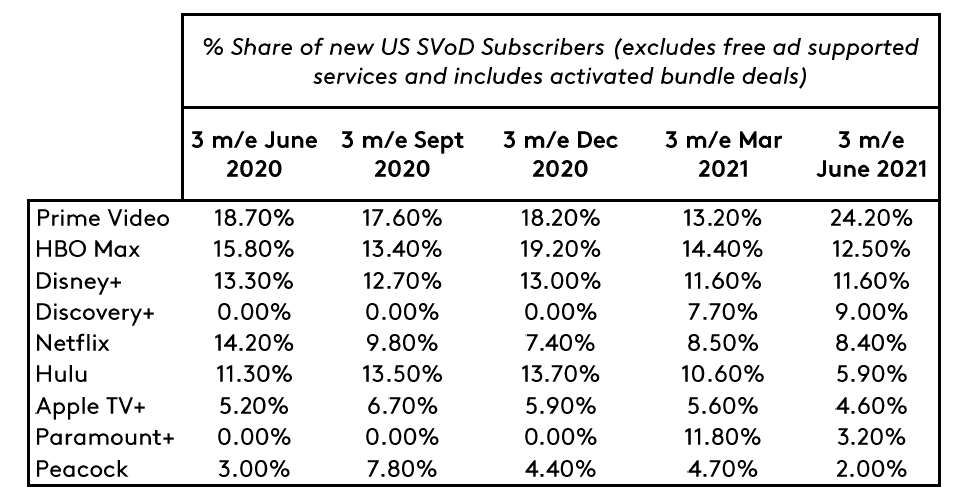

The US Subscription Video on Demand (SVoD) market may have just entered a transformational period. Entertainment on Demand, the solution measuring streaming service subscription levels, reveals the following subscriber behaviours in the US for the second quarter of 2021:

- Amazon regains the top spot for new subscribers for the first time since Q3 2020.

- Discovery+ leaps to the #2 spot in terms of new subscribers, in just its second full quarter of operation.

- Netflix installed base falls to 2/3 of US subscribers, its lowest penetration yet, as viewers trade in for newer offers.

- New US video subscribers dropped from 12.9% of US households to 3.9% year on year, while Amazon Prime Video growth remained consistent... posing serious competition for Netflix.

- The proportion of US households who have a video subscription has remained consistent at 74.6%, meaning there are now 95.8 million households with subscriptions, as of June 2021.

- In its second quarter, Discovery+ wins 1 in 10 new SVoD subscribers.

- Disney+’s Wandavision celebrates being the top-rated title for the second quarter in a row, with Hulu’s The Handmaid’s Tale in #2 and Mare of Easttown on HBO Max in third place.

Performance highlights across the major vendors include:

Amazon Prime Video’s growth remains strong

Whilst most services have suffered a reduction in new subscribers for Q2 2021, Amazon Prime Video has gained market penetration (up +3% YoY to 58%) and ranks first place for share of new subscribers. Looking at these new subscribers’ path to purchase, Amazon Prime Video is gaining through owned touchpoints such as offering a free trial and subscribers visiting Amazon.com. Amazon Prime Video is currently amongst the highest for free trials at 31%, beaten only by Apple TV+ at 37%. Both factors indicate that Prime Video is still benefitting from the increase in Amazon Prime subscriptions taken out during lockdown.

As well as gaining new subscribers, Prime Video’s average stacking of subscriptions has only increased from 2.6 to 2.8 YoY, compared to the market average of 3.1 to 3.8. This means there is less competition for viewership time and indicates that subscribers are getting what they need from fewer services. Examining the reasons for satisfaction, Amazon Prime Video scores higher than the total market for touchpoints such as ease of use (48% vs 44%), the amount of original content (44% vs 41%) and value for money (44% vs 41%).

As people return to bricks and mortar stores, it will be interesting to see whether Prime Video’s original content can carry them through and prevent subscribers from cancelling their Prime subscription.

Over the last year, despite new entrants to the market like HBO Max, Discovery+ and Peacock, Amazon’s acquisition has remained strong. This reflects the calibre of original content such as The Boys and The Marvellous Mrs Maisel.

Netflix experiencing competition from newcomers

Netflix has not fared well in garnering new subscribers this quarter. Netflix’s share of SVoD-enabled households is at its lowest, down to 67% from 74% in Q2 2020, and similarly their share of new SVoD subscribers hit 6% this quarter, down from 13% last year. Although share of the market outranks the competition, the saturation of the US VoD market may be resulting in Netflix subscribers trading the service in for a newer model. Whereas Disney+, Hulu and HBO Max take the top spots for content this quarter, Netflix comes in fourth and fifth position with The Crown and Lucifer. This is the first time they have missed out on a top three spot for content enjoyed for at least the past 5 quarters.

Further indication that Netflix subscribers are picking up new services comes from the average number of VoD subscriptions. Netflix went from having the lowest stacked subscriptions of the main services at 2.5 last year to 3, meaning that Prime Video now has a lower average. This is another indication of Amazon Prime Video managing to navigate the new landscape. In addition, the most common stacks for Netflix subscribers are Netflix, Amazon Prime Video and Hulu. Netflix should be cautious of this competition, as the cost of stacking can quickly add up and Netflix subscribers top planned cancellation reason is to save money (31%).

Earlier in the year, subscribers were concerned that Netflix was preparing a widescale crackdown on account sharing; however, the co-CEO Reed Hastings has reassured viewers that this isn’t the case.

Interestingly, Netflix has the highest proportion of subscribers who say that someone else pays (27.4%), compared to Disney+ (26.3%) and Hulu (23.1%) suggesting a lot of account sharing is taking place. Perhaps this media attention has cast Netflix in a negative light in the eyes of some subscribers. This may explain why Netflix received its lowest NPS score over the last 5 quarters with a score of 37. Luckily, this has not equated to planned cancellations, which sit at a steady 6% for Q2 2021.

Stacked subscriptions continue to climb

With three quarters of US households now accessing VoD services, room to grow is slowing and we’re seeing less gateway subscribers entering the market. This is driving the competition as existing SVoD households shop around for the content they love. Price sensitive consumers in the US now have more options than ever to drive down subscription costs, with existing services splitting out their offerings into premium, ad-supported and free tiers. HBO Max, for example, is launching an ad supported service as of this month. For those stacking multiple subscriptions, $9.99 for HBO’s ad-supported version is more attractive to a subscriber already paying $30/40 a month for SVOD, than HBO Max’s $14.99 offer. If the content is there and the interface is good, consumers are still satisfied with ad-supported services.

Evaluating the first 6 months of Discovery+

The newest member of the SVoD family, Discovery+ has captured a tenth of all new subscribers and is rated first for satisfaction with the quality of the shows. In its first 6 months, Discovery+ is already delivering a great onboarding experience for new customers, which is rivalling Netflix. The two services sit in top place when it comes to ease of setting up the service on a device (8.6 average score) and sign up being simple and intuitive (8.6). Furthermore, Discovery+ beats Netflix on subscribers being able to find content they wanted to watch (8.5), although Disney+ performs strongest on this onboarding touchpoint (8.6). As more subscribers will be coming to the end of their free trial in the following months, it’s important for Discovery+ to keep them engaged. Although only capturing 3% of the market penetration currently, if they can continue to boost their share of new subscribers and push out new content, Discovery+ could be a service to watch out for in the future.

Access the interactive dataviz for more information.