Our Marketing Trends 2024 have been sourced from across Kantar. We look at macro and micro trends for marketers to consider as part of their brand growth journey, and how they might suit their own objectives. From insights to behaviour, from culture to data, we cover some of the key trends that we see emerging and growing over the next year.

Jane Ostler – EVP Global Thought Leadership

According to Kantar’s Media Reactions 2023 , 67% of marketers feel positive about the possibilities of Gen AI. This optimism indicates a rapid and exciting adoption of the new technology. The industry is exploring opportunities to use Gen AI to create efficiencies in the way we develop and personalise creative and innovate at scale.

We have already seen marketers and agencies experiment with Gen AI by creating more visual concepts to benefit discussions, infusing new impulses into the ideation stage, as well as aiding in crafting storylines. There might even be space for synthetic media planning in our future.

In 2024, as AI brings more opportunities for scale, efficiency and creativity, there will be even more content competing for eyeballs. In this landscape, the need to understand the effectiveness of creative content will grow further, and those who use AI measurement approaches that match the pace and scale will be better prepared.

Kerry Benson

Vera SidlovaCulture comes first: marketers follow culture to connect with consumers in an accessible language of characters, fashion, music, lingo, norms and aspirations. Success comes when marketing aligns with culture, and is lost when marketing offends it.

Kantar MONITOR tracking in the U.S. finds that nearly two-thirds of people agree that they want brands that “align with” their personal values. Globally, 80% say they “make an effort” to buy from companies that support causes important to them. However, consumers don’t always do what they say. This is known as the purchasing value-action gap. But purchasing is not the only way consumers express their cultural preferences.

Consumers are increasingly ‘acting out’ when brands fall out of alignment with culture. The futures practice of Kantar finds that this new terrain of more demanding consumers is increasingly confrontational, as higher expectations about brands come together with changing norms about conversations and disagreements. As we look ahead to 2024, confrontational risk must be embedded in marketing planning. Not at the expense of product mission, just more in sync with culture.

J.Walker Smith

There is increasing publicity about brands who take an activist stance. Meanwhile, social media creates a global stage and democratises opinions, which intensifies the risk and scale of consumer backlash.

Alongside this, we have high growth formats where marketers may have less control. Influencer content is consumers’ preferred online channel for advertising (Media Reactions 2023). Half of marketers globally say they invested in influencer content in 2023, and 59% say they will increase spend on influencers in 2024.

Like celebrities, influencers’ actions have an impact on the brand they are working with, so they need to be given clear parameters, while remaining authentic.

So is brand control waning?

If brands decide to take a stand, they need to take care not to be cancelled for being inappropriate (whether on purpose or not). Marketers will need to become more culturally connected and learn how to navigate any possible backlash to their content, or influencer content, on social media. Brands who speak out in a way that’s consistent with their DNA and stand up for what they believe, can make their way into consumers’ hearts, despite possible short-term controversies.

Gonca Bubani

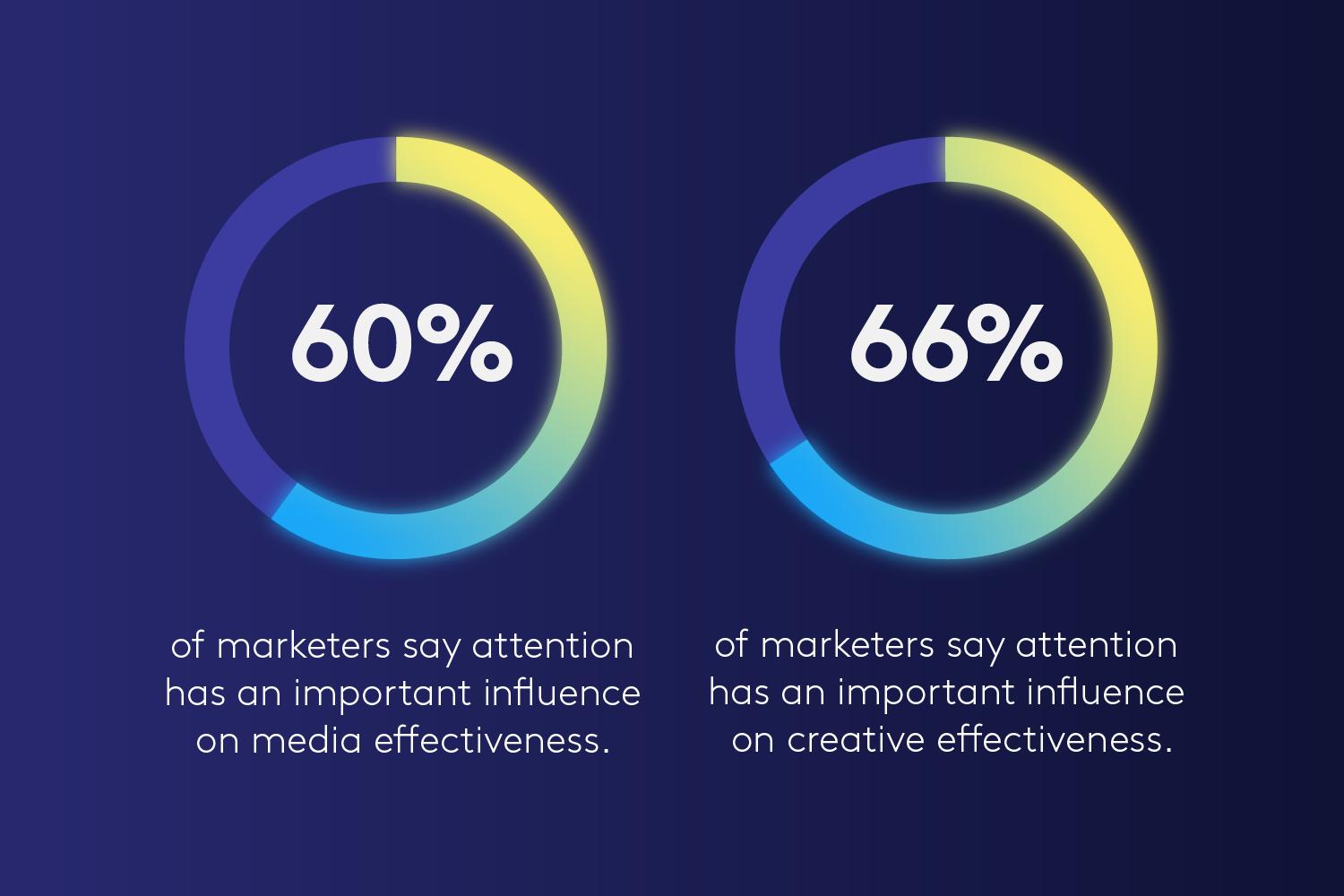

The importance of Attention for both creative and media effectiveness is now becoming established among marketers, who can optimise ROI by developing ads and media plans which maximise their attention per dollar spent.

Marketers are now recognising that attention is layered, with audience measurement needs evolving beyond viewability. So it’s surprising that behavioural viewing measures (like time viewed) are still the dominant attention measurement approach (62% of marketers prefer this, according to Kantar Media Reactions 2023 ). Marketers clearly feel these measures are an acceptable proxy for understanding how an ad has worked after launch.

But we also see a trend towards gaining a deeper understanding of the quality of consumers’ creative attention, and this is where we see facial coding and eyetracking techniques are gaining prominence. These techniques seem increasingly likely to merge, as some facial coding suppliers now include a gaze measurement component.

AI-based creative and media predictions of attention are being used less than observational techniques. However, it is no surprise that the use of AI-based attention predictions is now rising. They are destined to play a greater role in 2024, allowing marketers to measure attention at scale for digital ads.

Vera Sidlova

Duncan SouthgateCorporate metrics increasingly highlight the importance of long-term value creation, inclusivity, positive community, and environmental impact.

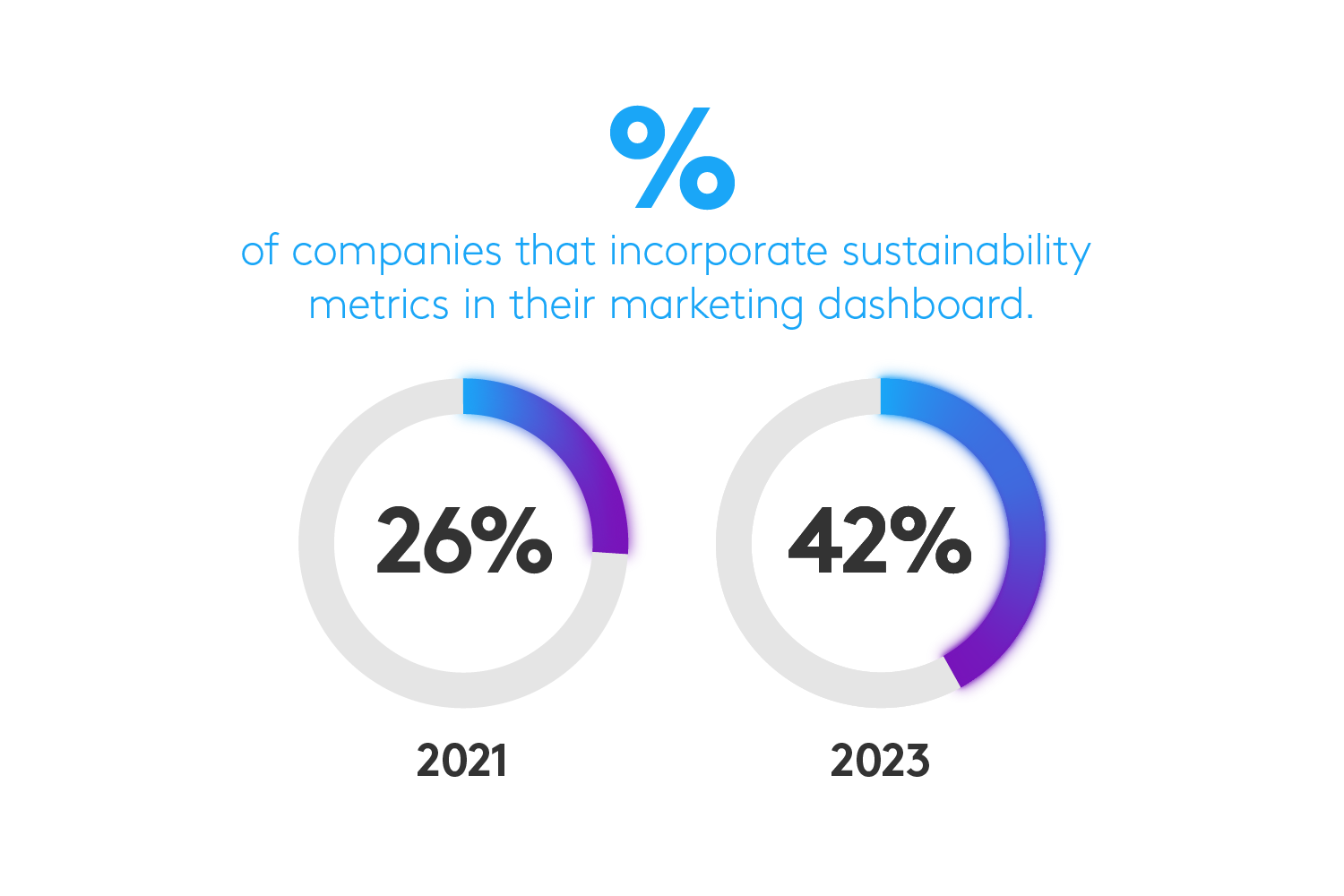

According to the WFA and Kantar's Sustainable Marketing 2030 report, the presence of sustainability metrics on marketing dashboards has surged. In 2023, 42% of companies incorporate these metrics, compared to just 26% in 2021. Where companies are further advanced in translating their sustainability agenda into their marketing function, the number rises to 62%. When integrating sustainability into P&L incentives, this adoption drops (44% advanced, 10% starters).

In 2024, we see a shift towards sustainable innovation, inclusive communication, and strategic PR to foster trust. It involves balancing long term brand development with product marketing and short-term metrics. Consumers increasingly seek companies that contribute to environmental and social solutions, as reflected in the 31% growth of Kantar BrandZ top-rated Sustainability brands in 2021 —compared to 23% for the top 100 brands. So balancing profit, planet, and people need not be a compromise, but can be a valid business strategy.

Carol Horsley

Brands perceived as innovative afford 3x more growth than brands that aren’t, according to Kantar’s BrandZ 2023 data.

So why do we see such low levels of innovation in post-Covid times? In the UK, new launches are at their lowest for a decade, according to Kantar's Worldpanel division. The innovation we are seeing is, at best, just small renovations (Europanel BG20, 2023).

The good news is marketers recognise the need to step up to do more in innovation, in particular sustainable innovation. Over half of marketers (57%) agree that they need to innovate for competitive advantage in this space (Kantar sustainable marketing 2030).

At the Kantar Outstanding Innovation Awards 2023 , we identified five characteristics in common in brands that achieved a competitive advantage through innovation: they are consumer-centric; they build their innovations from strong brand foundations; they shape the future of their category, and are typically ahead on sustainability. They do this by being brave and via testing and learning.

Innovation, particularly radical innovation, should and will be a strong trend in 2024 for brands who want to find the best path to incremental growth.

Nicki Morley

Micro brands are driving disproportionate CPG growth as they seek to challenge established concepts, ideas, consumer needs, and occasions. These brands also seek to change hearts and minds.

For large CPG brands to win, they must build marketing capabilities across six critical areas including: agility and speed to market, consumer-centric approach, innovation and disruption, data-driven decision-making, direct-to-consumer expertise along with storytelling that focuses on meaningful difference.

In 2024, challenger brands will continue to have success globally by focusing on three areas :

- Niche markets and unique products

- Embracing social platforms and influencers to grow

- Leading with purpose and sustainability innovations.

Barry Thomas

However, 2024 will also see more sophisticated price management, such as partitioning the market to address less constrained customers, as well as value-seeking consumers through premiumisation.

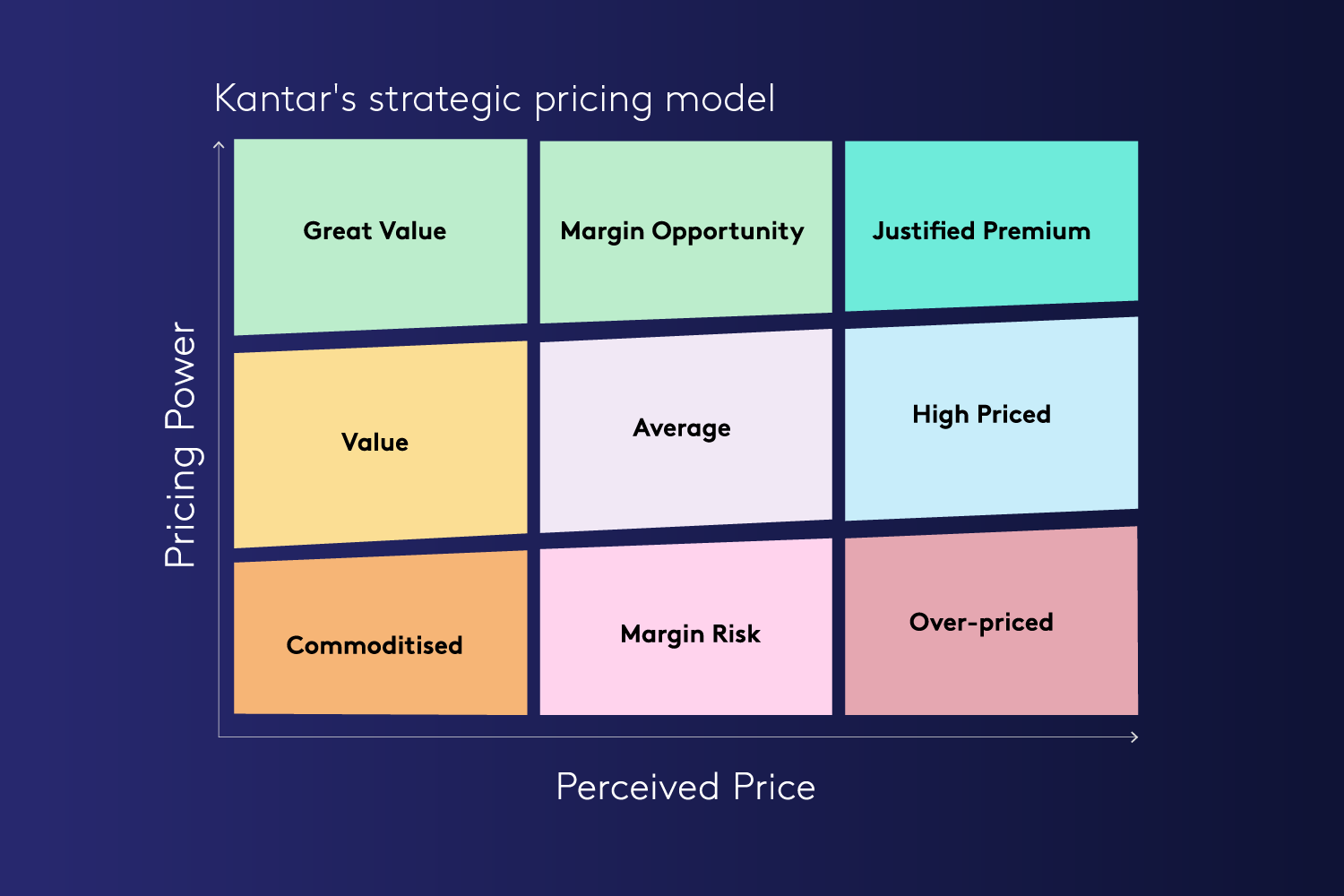

Top brands are increasing their pricing power: in the 2023 Kantar BrandZ rankings, 52% of brands achieved top tier in our strategic pricing model, up from 42% in 2020. This model combines brands’ relative price perception with the pricing power in their brand equity.

In 2024, marketers will lean into pricing management to ensure that price and value work in sync. Answering three fundamental questions will help.

1. Do consumer expectations of your relative price match the reality in the market?

2. Do you have enough equity to justify your relative price?

3. Are you fortunate enough to have ‘extra’ equity? It’s the brands in the green boxes in our model that can premiumise their offer and extend their brand.

So successful brands are becoming more premium – and we don’t expect this trend to stop in 2024, as it increases the brand portfolio’s margins and maximises share across all customer segments.

Graham Staplehurst

Moving on from earlier stages of keyword-based search and matching, and algorithmic ranking and relevance, search is now going through a disruption period from AI, large language models era

In 2024, this means that search is crucial to understand the “messy middle” of a brand’s customer journey. Analysing the intent of keywords and how they are used, regardless of the digital touchpoint, is key, alongside tapping into emerging trends in the category. This is the time for brands to review their digital strategy and content to ensure that it shows up where consumers are, with authority and an intention to stay ahead of the curve.

Winnie Cheng

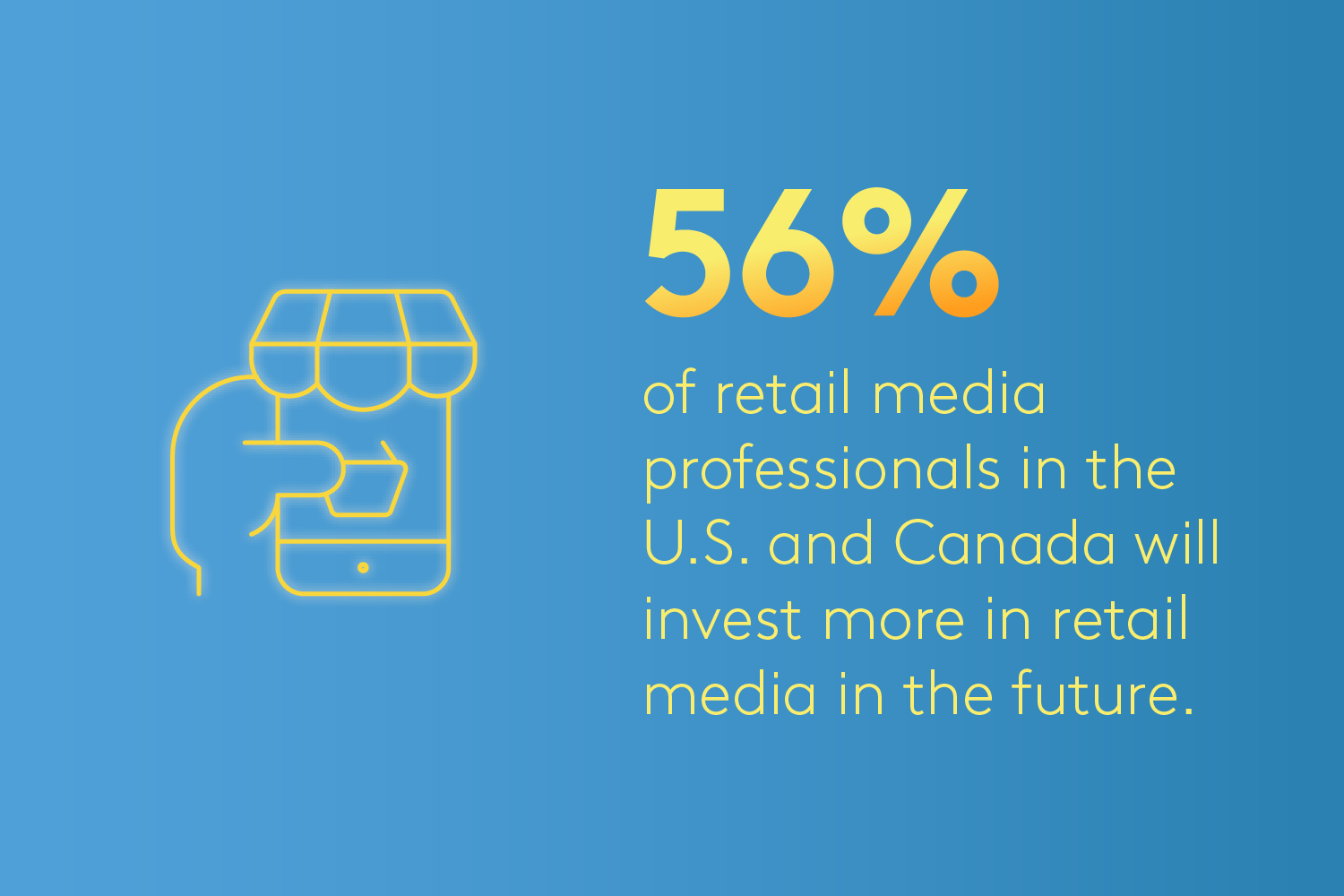

A retail media network is an advertising business that a retailer sets up to sell advertising space across the retailer’s owned properties and paid media. The ability of retail media to leverage rich, first-party consumer purchase data helps to fill the void left by cookie deprecation and removing third-party identifiers.

Marketers are anxious about shifting dollars away from established channels. They want an independent, third-party source to validate “am I getting what I paid for?” in terms of audience, delivery, etc. For sellers, retail media networks unlock an additional source of revenue in uncertain economic times.

Looking forward to 2024, buyers and sellers need media-agnostic, independent measurement to support proof of channel performance and to create better advertising experiences. Third party measurement will play a key part in the development of retail media.

Jed Meyer