The latest report from Kantar Worldpanel shows that the sales of China's fast moving consumer goods (FMCG) in Q3 2021 fell by 1.0% compared to the same period last year. Under the dual impact of sporadic outbreaks of the COVID delta variant and floods in a few regions, the total FMCG market experienced further weakness compared with Q2, with East China suffering the most. The market had seen a steady recovery since the second quarter of 2020 but the stagnation in the recent two quarters has brought about a higher level of uncertainty towards the growth prospects for full year of 2021. In the latest quarter, food and dairy sectors reported a weaker performance, with sales down by more than 2%, while the home care sector remained the bright spot with a year-on-year growth of 6.2%. This indicates that consumer choices are making some permanent shifts in this era of the ‘new normal’.

The out-of-home food and beverage market in China's upper-tier cities continued to rebound, with a year-on-year growth of 4.4% in Q3. Beer, packaged beverages and on-premise drinks made major contributions to the growth. Tea-based drink is one of the important driving forces behind the booming outdoor consumer market. Driven by strong demand, the consumer base of tea-based drinks expanded by more than 10% year-on-year. At the same time, the office consumption occasions continue to thrive, leading to new growth opportunities for many categories and brands.

Membership store and omni-channel digitalization accelerate the transformation of modern channels

Modern trade (including hypermarkets, supermarkets, and convenience stores) experienced a 2.9% fall in sales, compared to the same quarter in 2020. Sales in large supermarkets and hypermarkets declined by 5.4% and 6.1% respectively year on year. Small supermarkets are the only growing channel with a year-on-year increase by 7.9%, driven by rising shopping frequencies. It can be seen that consumers’ preference for proximity shopping is still strengthening even as consumers get back to their normal lives. Intensified market competition, emerging business models (frontend warehouse for fresh foods and community group buy) are taking more shopper traffic from large-format stores.

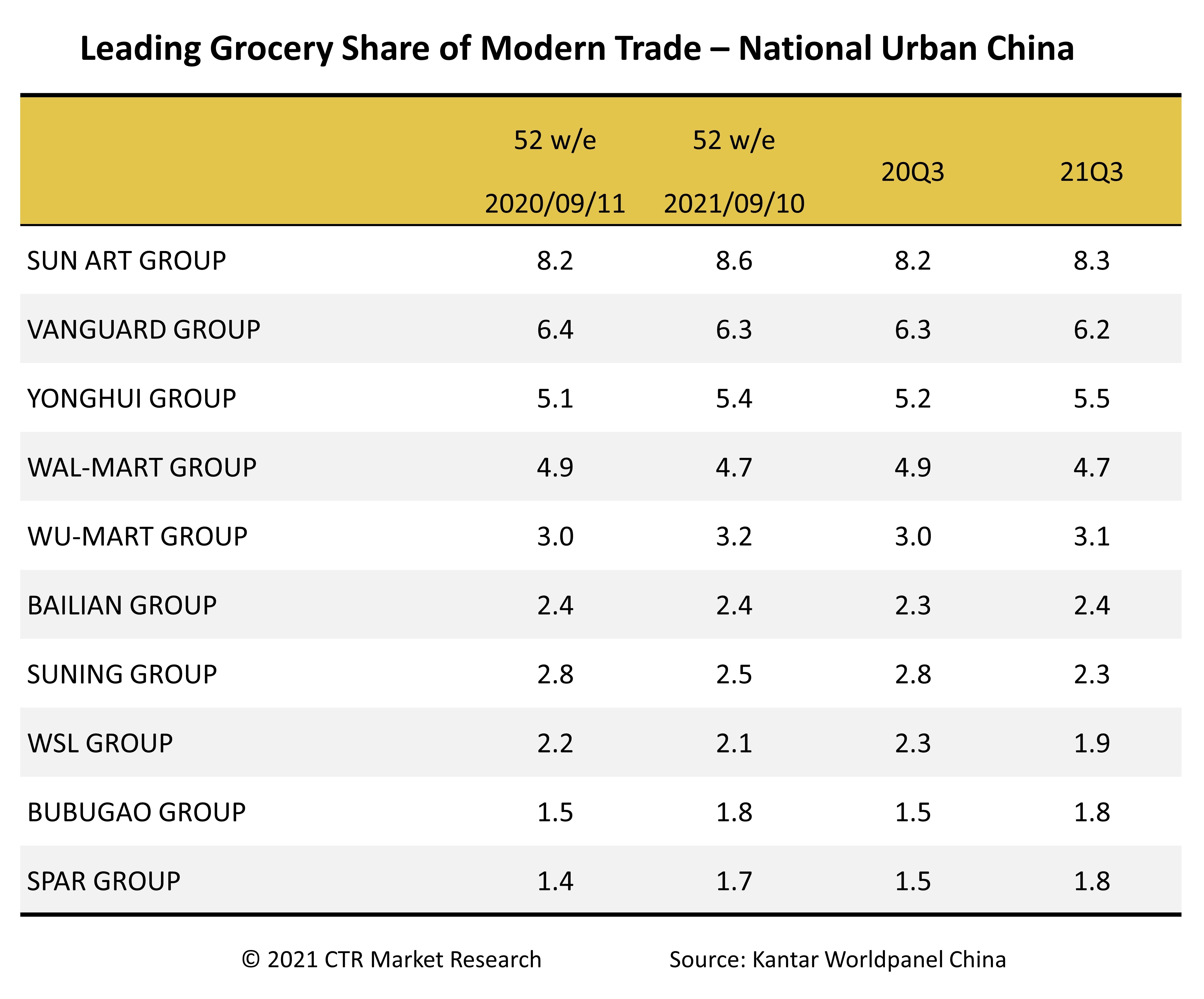

Among the major player, Sun Art Group kept leading the market with a value share of 8.3%. Vanguard Group firmly occupied the second pace, with a 6.2% market share in Q3. Vanguard has introduced innovative banners in recent years, such as Vanguard Mart, Vanguard City, etc. to target specific customer needs while re-focusing their resources and investments in selected regions within China. On the back of their supply chain strength, they used packaged foods rather than fresh foods as key traffic builder to lure shoppers back to their stores.

Membership store models are one of the most popular formats that retailers have launched recently. The latest flagship store of Sam‘s Club in Shanghai immediately became a popular shopping attraction amongst middle class shoppers, as it offered more differentiated merchandise and high value-for-money proposition. Hema X, Alibaba’s first membership wholesale store, is also joined by Metro, Carrefour, and Beijing Hualian in the new battle of membership store formats. The requirement to constantly add innovative and highly differentiated own-label products is also a test of retailers’ shopper insights and supply chain strength.

Amongst regional retailers, Wu-Mart Group grew 0.1pt year-on-year of its share in the third quarter. After the acquisition of Metro, Wu-mart continued to digitize its store operations with the empowerment of Dmall. At the same time, its own brands and imported goods continue to generate more sales. Both Bubugao Group and SPAR Group increased their market share by 0.3pt year-on-year to 1.8%. The online penetration of Bubugao rapidly increased following the outbreak of COVID-19 and its deployment in the community was further improved.

O2O further integrated online and offline operations

Instant retail (O2O) maintained a strong growth trend since 2020. The latest report of Kantar Worldpanel indicated that 57% of urban households used O2O home delivery services to purchase FMCG in the first nine months of this year. The penetration rate in upper-tier cities reached 65%, while that in lower-tier cities hit 52%. Among different regions, the number of O2O users in South China increased faster year-on-year than any other region. Compared with the peak time during the pandemic outbreak, consumers in China spend less on the O2O platform on each shopping occasion, but significantly increased the number of orders. This reflects that O2O has gradually moved from high-frequency and essential categories such as fresh food to cover all categories and all occasions.

JD and Tmall launched their own enhanced versions of instant retail, with the promise of “One-Hour Delivery”, utilizing platforms such as Dada Group and Taoxianda to deliver the products stocked in the shops nearby. This indicates a deeper integration of online search with products and logistic capabilities in the offline world. Kantar Worldpanel suggests that O2O brings different level of incremental sales opportunities to different categories. Through the effective use of online traffic, retailers can effectively upgrade their existing businesses, meeting the needs of consumers in more occasions, and breaking away from the challenging shopper losses.

The analysis of Kantar Worldpanel on shopping receipts also reveales that the community group buying (CGB) market has encountered strict policy and market supervision. It stopped growing in Q3, with some players phased out of the market. However, still nearly 32% of consumers in urban China purchased FMCG through Community Group Buy platforms in the latest 12 weeks, indicating that the consumer base remained solid. Leading e-commerce companies are also transforming their group buying model under the new policy. High-frequency community group buying based on fresh and FMCG is in line with their strategy of developing local community ecosystems. As CGB steps into the next stage of development, key players will turn from price competition to full competition in the supply chain and operation excellence.

Omni-commerce era in virtual shopping

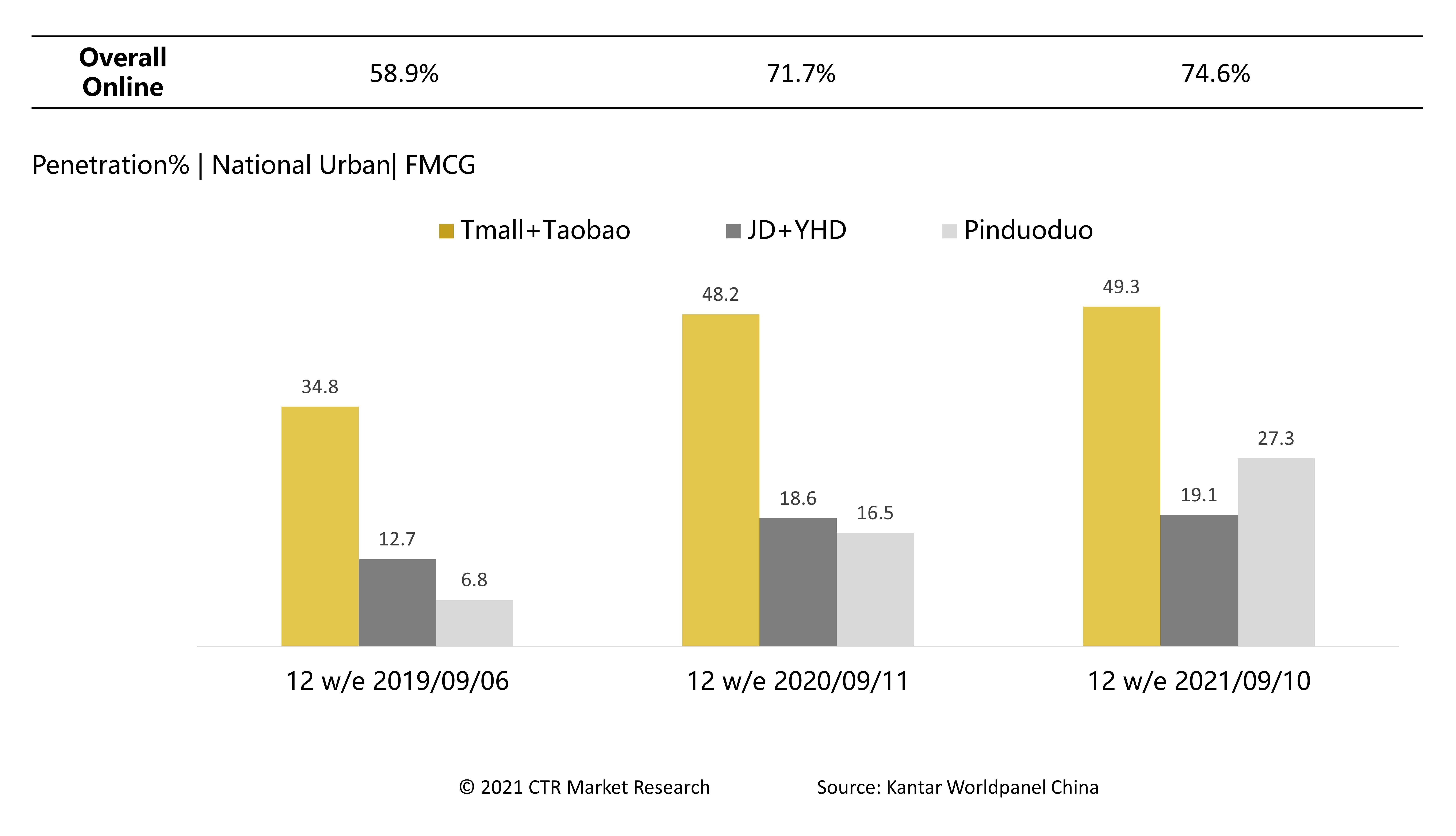

The online shopping channel continued its growth trajectory, with a 11% year-on-year rise. The growth of upper-tier cities rebounded, and their performance was better than that of lower-tier cities. The latest report shows that the online shopper base is still expending. Although consumers shop with smaller baskets, they placed more orders compared to last year. By Q3 2021, eCommerce holds around a 29% share of the total FMCG market in China. More than 74% of Chinese urban households purchased FMCG online during this quarter.

Though growing at a slower rate, Alibaba platforms still attracted 49.3% Chinese urban families in Q3. In order to improve the online shopping experience of buyers in lower-tier cities, Tmall Supermarket has deployed frontend warehouses in 132 tier 4 and 5 cities across the country to achieve one-hour delivery of general groceries. Pinduoduo kept its strong expansion, with more than 27% of Chinese urban families buying FMCG on Pinduoduo at least once in Q3. It is reported that the annual active buyers of Pinduoduo reached nearly 850 million as of H1 2021, with its users becoming more active and engaged. In addition to traditional e-commerce platforms, e-commerce services developed on the back of short video platforms is developing rapidly and becoming more popular in lower-tier cities. Based on content, short video e-commerce attracts customers with specific interests and actively promotes products to boost conversion and repurchase. This opens up new growth opportunities for FMCG brands.

Notes to editor:

1. Kantar Worldpanel China continuously measures household purchases over 100 product categories including cosmetics, food and beverages and the toiletry/household sector. Its national urban panel covers 20 provinces and four municipality cities (Beijing, Tianjin, Shanghai and Chongqing).

2. Kantar Out-of-Home Panel tracks 8,000 individuals covering Key & A cities.

3. International retailers refer to retailers originated outside Mainland China, Taiwan, Macau, and Hong Kong.

4. Lower city tiers include prefecture level cities and county-level cities & counties.

5. Suning Group includes Carrefour and Suning CVS; Wumart Group includes Metro, Wumart, and New Century; Better Life Group includes BBG Department Stores, Nancheng Department Stores, and Jiarunduo.