The Chinese New Year of 2022, which officially starts on January 31 (the Chinese New Year’s Eve), will be the third Spring Festival since the outbreak of the COVID-19 pandemic. Due to the pandemic’s impact, the usually happy family reunion seasons have been significantly changed – in 2020, the festival was overshadowed by the sudden emergence of the pandemic and people in most cities were required to stay at home; in 2021, people were encouraged to cancel home-going trips.

In 2022, even though there are no more nationwide restrictions on cross-province/city travels, sporadic confirmed cases in various parts of China, such as in Beijing, Shanghai, Hangzhou, Tianjin, etc., have triggered small-scale lockdown/quarantine measures at local levels. Many local governments have also enhanced requirements for people to show negative COVID-19 test reports. These unforeseeable changes have made “uncertainty” the theme of the Chinese New Year season in 2022.

To help brands and marketers understand how Chinese consumers plan to celebrate, Kantar launched a nationwide Chinese New Year survey between January 17 and 22. We collected 1,000 representative answers on the Chinese mainland through our WeChat panel. Here are the key findings:

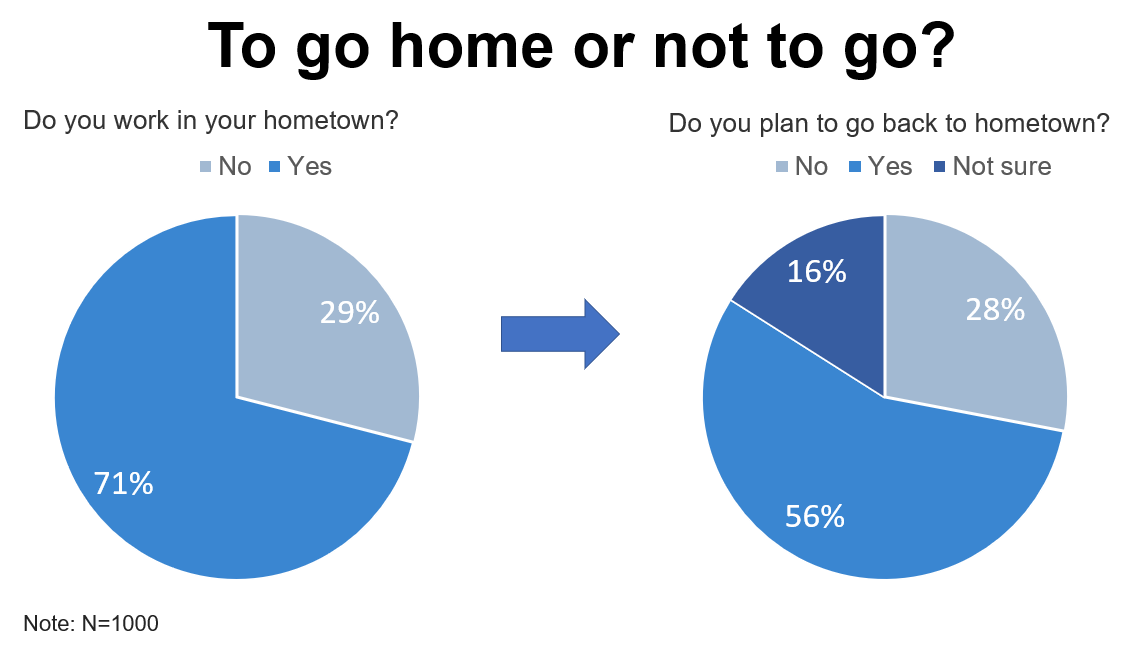

The ‘uncertain’ 16%

Among all respondents, 29% are working away from their hometowns. By the time the survey closed, 16% of these people were still not sure if they wanted to go home, and only 56% were sure they would definitely return to their hometown. As more confirmed cases have been reported in more cities, and local control measures for home-coming travellers kept changing, we would assume that more people would need to think twice about their plans. For example, in Shanghai alone, more than 940,000 train tickets have been refunded by January 26.

For those people who have already cancelled home-going trips, 88% cited COVID-19-related factors as reasons, such as “concern of meeting a sudden outbreak on the road” (44%), “due to the pandemic situation, my employer asked me not to leave my current city unless necessary” (43%) and “concern of being caught in pandemic at my hometown” (24%).

For people definitely going home, we asked about their choice of transportation. “Train” and “Private cars (passengers including only myself and family members)” are the most mentioned options, both by 40% respondents.

For those who were not sure, “due to pandemic, I’m not sure if my family member can go home” is the most chosen reason, which was mentioned by 60% of respondents.

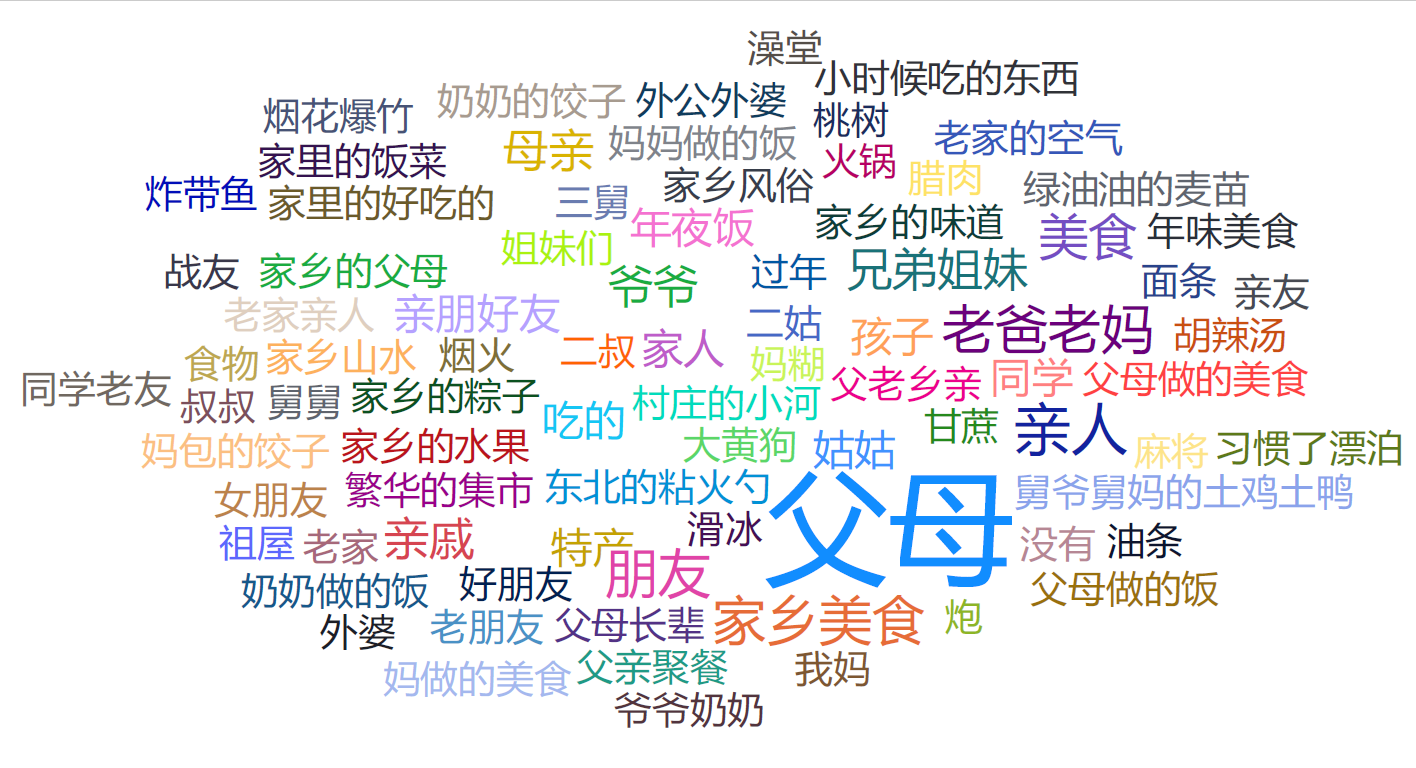

So what will these people miss most about their annual trips home? We invited them to tell us, and saw that “Father and Mother” (父母、老爸老妈), grandparents (爷爷奶奶外公外婆), friends (朋友战友同学老友) and all types of hometown delicacies were among the top responses. So, apparently, family and food are the two biggest themes.

(sorry, the word cloud is in Chinese …)

Rebound in out-of-home activities

Though there is some uncertainty, we can be sure that out-of-home consumption in this Chinese New Year will be higher than in 2021. As the overall domestic condition of COVID-19 has eased, and people are more used to on-going control measures, we have noticed that more people have planned out-of-home activities.

About 28% respondents planned to “eat Chinese New Year’s Eve dinner in restaurants” – a much higher proportion than in 2021 (12%). “Travel within the city that I will stay during festival” is on 21% respondents’ to-do list, also a big rise from 12% in 2021. Watching movies has further consolidated its position as a new tradition during Chinese New Year – 36% respondents plan to go to the cinema this year, compared to 26% last year. Given that the 2021 Chinese New Year box office hit a record-high of 7.8 billion yuan, we can expect an even stronger performance from movies this year.

Other offline gathering activities are also on the rise. “Dine out with friends and relatives (not including New Year’s Eve dinner), “visit friends and relatives at their home” and “play mahjong with friends or family” were all mentioned by more people than last year. At the same time, purely indoor activities were less popular, including “watch TV/video at home by myself and/or with family members” and “play games connected with other players”.

William Wei, Director of Brand & Creative Practice, Insights, Shanghai, China, commented: “The survey results clearly indicate that the tendency for out-of-home consumption during the upcoming Chinese New Year Festival will be higher than a year ago. Brands in the dining, mobility and entertainment sectors shall focus on creating more diversified consumption occasions to better address and satisfy consumers’ desire to spend more in out-of-home occasions.”

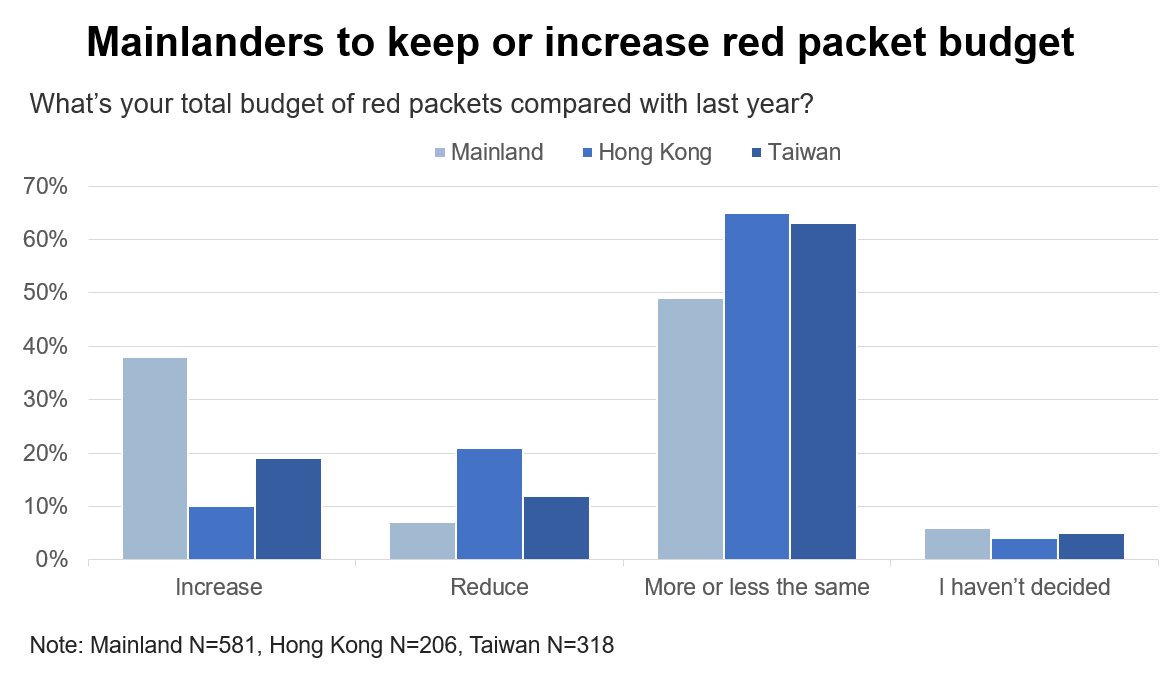

Red packet, the forever theme of Chinese New Year

Giving out a red packet is a key part of the Chinese New Year celebration. We also asked our respondents about their red packet plan across the three markets of the Chinese mainland, Hong Kong and Taiwan. The results showed that Chinese mainlanders are more likely to keep (49%) or increase (38%) their total budget, while in Hong Kong and Taiwan most people will keep the budget the same (HK 65%, TW 63%).

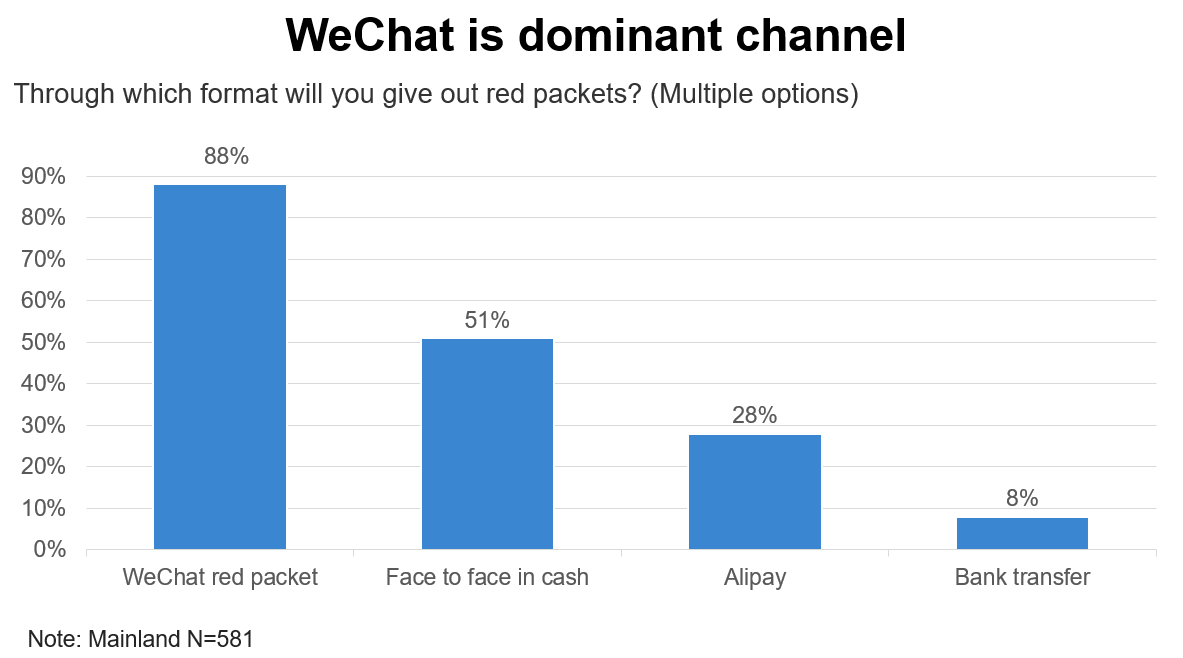

On the Chinese mainland, WeChat is the dominant channel (88%) for giving out red packets. Giving cash face to face ranked the second (51%) because it is a more ceremonial way, especially when the red package is given by an older person to a younger receiver.

* One survey was conducted on the Chinese mainland from January 17 to 22, 2022 through WeChat panel. Sample size: 1,000 real-ID registered users. Surveys were conducted in Hong Kong and Taiwan through Kantar’s LifePoint online survey platforms from January 17 to 21. Sample size: 500 real ID-registered panellists each. All samples are representative to their markets.